Technology

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

7 Ways to Grow Your Firm in 2022

Are you ready to grow your firm in 2022? There are several ways to do so, from adding more clients to offering additional services. While this list won’t tell you how to grow your firm or improve your existing services, it offers ...

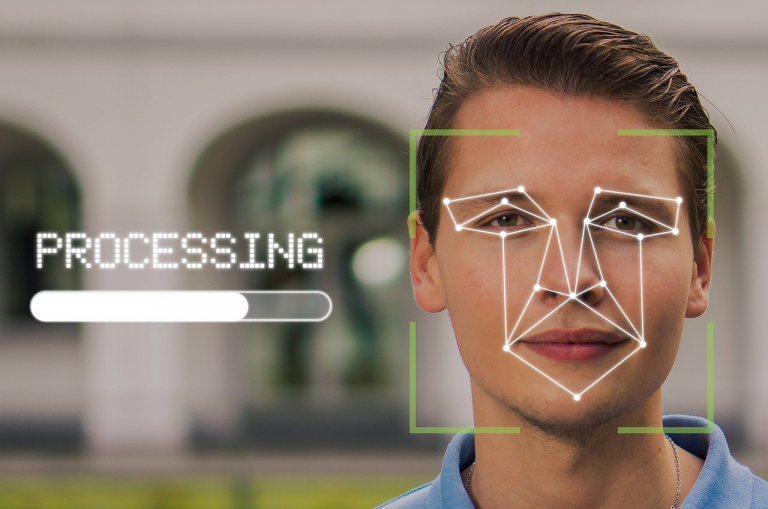

IRS to Start Requiring Facial Recognition for Tax Transcripts and Payments

That verification requirement will soon be required for all taxpayers to view other personal tax documents on the IRS website. Tax practitioners who use a secure service will still have access to IRS transcripts.

Verady Launches the Ledgible Crypto Platform

One of the biggest challenges for crypto holders and tax professionals is to account, track, and manage all the crypto data across multiple wallets and exchanges to calculate gains/losses and income. Holders do not receive monthly statements and this ...

Versapay Adds Executive Staff

Ward Schultz joins as Chief Financial Officer (CFO), Nancy Sansom joins as Chief Marketing Officer (CMO), and Alex Hoffmann joins as Executive Vice President of Payments.

States Look at Taxing the Metaverse, But What is It?

Sales transactions are presumed taxable in states with a sales tax (unless there’s a specific exemption or exclusion), most states haven’t yet clarified which sales tax laws apply to sales made in the metaverse. When will they start?

Hotel Industry Forecasts Improving Market for Lodging

The hotel industry will continue moving toward recovery in 2022, but the path will be uneven and potentially volatile, and full recovery is still several years away, according to a report by the American Hotel & Lodging Association.

The Tax Blotter – January 28, 2022

The Tax Blotter is a round-up of recent tax news.

Technological Advancements Continue to Change the Way Tax Pros Work

As we start the 2022 tax filing season, the future of work continues to be a topic of discussion among not only the tax and accounting profession, but globally, in every industry. The pandemic has changed how everyone works, lives and everything in ...