Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

WISP Required! Key Components in Your Firm’s Written Information Security Plan

While primarily targeted at companies maintaining more than 5,000 client records (think tax returns), certain safeguard components are required for firms with fewer than 5,000 records.

IRS, Treasury Issue Proposed Guidance on Monetization Options for Energy Tax Credits

The proposed rules released on June 14 focus on elective pay and transferability of credits under the Inflation Reduction Act.

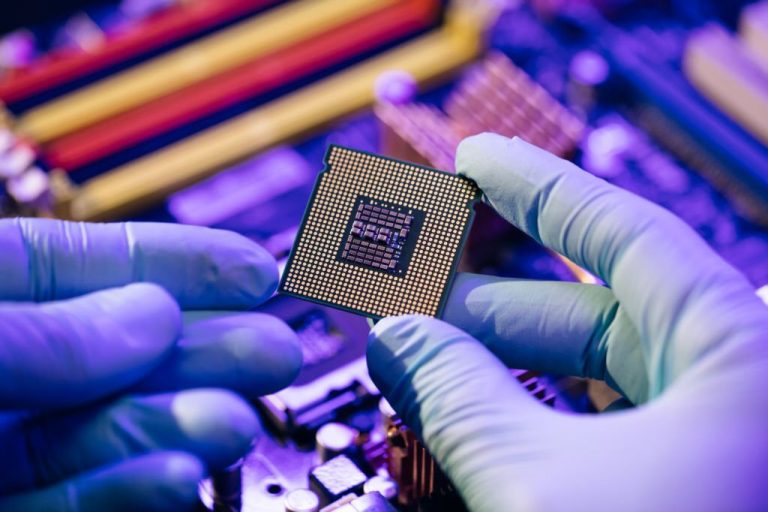

IRS Clarifies Elective Payment Rules for Semiconductor Chips Tax Credit

The CHIPS Act allows eligible taxpayers to make an election to treat the credit as a payment against federal income tax.

Redefining Success: What It Looks Like When Growth Isn’t the Top Priority

A lifestyle accounting firm emphasizes the personal lives of their employees in a way that focuses on balance, which may look different from a firm where scaling financial growth is the main priority.

When to Make Nondeductible IRA Contributions

When should you begin to make nondeductible contributions to your IRA?

AICPA Supports Changing Requirements to Form 1099-K Reporting Threshold

For many months, the American Institute of CPAs (AICPA) has expressed its concerns regarding the lowered Form 1099-K reporting threshold

Tax Curve Ahead for Business Vehicle Owners

Make sure you keep business use above the 50% level. In addition, maintain all the driving records required by the IRS.

![globe-flags[1]](https://stage-cpapracticeadvisorsite-firmworks.content.pugpig.com/wp-content/uploads/sites/2/2022/07/33706/globe_flags_1_.5ce342f3a9102.png)

Foreign Intrigue on Taxable Income

A self-employed individual may claim the foreign earned income exclusion on foreign earned self-employment income.