Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Hunter Biden to Plead Guilty to Tax and Gun Charges

Hunter Biden has been charged with illegally possessing a handgun in 2018 as well as two tax misdemeanors, for failing to file and pay taxes on time in 2017 and 2018.

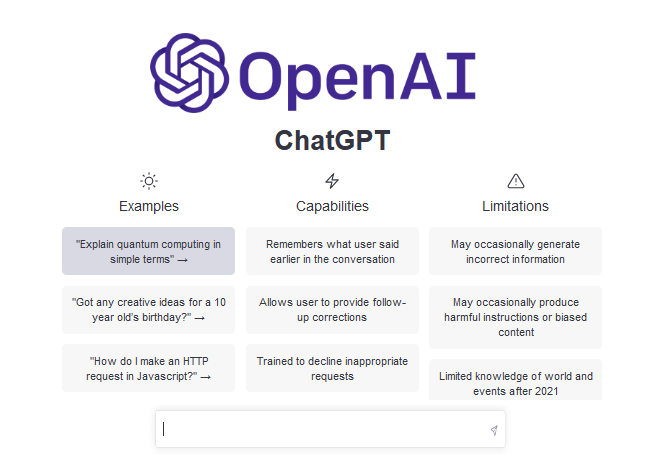

Avalara Launches Sales Tax Calculator Plugin for ChatGPT

Avalara is the first tax compliance software provider to work with OpenAI to use its protocol to build an integrated plugin for ChatGPT.

MyLawCLE and Tax Rep Network Partnership Provides Insider Knowledge on Working with the IRS

In addition to training sessions for IRS representation, the partnership will enable attorneys and law firms to explore adding new revenue streams to their practices with tax resolution services.

Conservatives’ Budget Plan Renews Battle Over Social Security Benefits, Tax Cuts

The proposal would gradually raise the age at which future retirees can claim full Social Security benefits from 67 to 69.

TIGTA: IRS Gave Out More Than $10 Billion in Excess Child Tax Credits in 2021

The IRS miscalculated 2021 child tax credit payments for thousands of eligible taxpayers as of May 5, 2022, TIGTA said.

Ins and Outs of the Home Sale Exclusion

Here are several key points about the home sale exclusion that you should know about before you hand over the keys.

Key In on Improved Home Energy Credits

The IRS is reminding taxpayers that they may qualify for expanded home energy credits in 2023 (IR-2023-97, 5/4/23) There are two types of credits.

The IRS and Gambling – The Tax Blotter – June 16, 2023

Taxpayers can claim a limited deduction for gambling losses, but the IRS keeps close tabs on these write-offs.