Taxes

Latest News

IRS-CI Releases Its FY 2024 Highlight Reel

AICPA Releases Statement on BOI Injunction, FinCEN Appeal

PCAOB Says Audit Firm Culture is Tied to Audit Quality

PCAOB Punishes New York Audit Firm, Three Partners for Deceiving Inspection Staff

2012 Review of EG Systems, Inc. – The W-2 / 1099 Filer

EG Systems, Inc. – The W-2/1099 Filer800-264-3155www.W21099.com From the Nov. 2012 Review of W-2/1099 Preparation programs. Best Fit: Accounting practices managing year-end reporting for multiple clients. Strengths Comprehensive state, federal and local form support Batch filing and printing options Supports multiple data formats Remote and local backup options available Potential Limitations ATF Payroll offered as […]

2012 Review of Avalara – AvaTax 1099

Avalara – AvaTax 1099877-780-4848www.avalara.com From the Nov. 2012 Review of W-2/1099 Preparation programs. Best Fit: Accounting practices preparing and managing year-end compliance for multiple clients. Strengths Built-in error checking and TIN Validation Comprehensive mailing and filing service Good support of forms in the 1099 series Potential Limitations Does not offer W-2 preparation No built-in client […]

2012 Review of Advanced Micro Solutions – 1099-Etc

Advanced Micro Solutions – 1099-Etc800-536-1099www.1099-etc.com From the Nov. 2012 Review of W-2/1099 Preparation Programs. Best Fit: Firms managing after-the-fact payroll, as well as quarterly and year-end information reporting for multiple businesses. Strengths Imports from a variety of file formats Supports federal, state and local forms Comprehensive e-filing and mailing options Potential Limitations No time and […]

2012 Review of American Riviera Software – Magtax Professional

American Riviera Software Corp. – Magtax Professional805-504-1366www.Magtax.com From the Nov. 2012 Review of W-2/1099 Preparation Programs. Best Fit: Firms managing year-end compliance and electronic e-filing for multiple business clients. Strengths QuickBooks integration Import/Export capabilities that support various file formats Plain paper and pre-printed form printing Potential Limitations Does not offer after-the-fact payroll No built-in invoicing […]

IRS to offer webinar about Registered Tax Return Preparer test

The Internal Revenue Service’s next IRS Live webinar, “Get Prepared: A to Z Details on the Registered Tax Return Preparer Test” is Wednesday, Oct. 31, at 2 p.m. Eastern Time.

New River Innovation Releases Web-based IRS Research Application—Beyond415Guidance

From Darren’s CPA Practice Advisor blog: My Perspective. Just this week, a new cloud-based IRS “research center” application was released to the tax and accounting profession—Beyond415 Guidance. The stand-alone app from New River Innovation offers practical and up-to-date guidance for resolving issues after tax filing. Product features include searchable guidance that covers individual, business, and […]

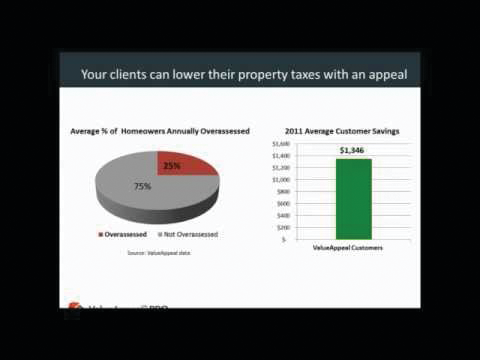

New Trends for Helping Clients and Growing Revenue by Randy Johnston and ValueAppeal

Thought leader Randy Johnston (the inaugural member of the Tax and Accounting Hall of Fame) discusses new trends for making engagements profitable while saving clients money.

It’s Almost Oct. 15… Are You Ready

With only a few days left until Oct. 15, the Illinois CPA Society is urging individual filers who had an extension to remember the deadline.