Taxes

Latest News

IRS-CI Releases Its FY 2024 Highlight Reel

AICPA Releases Statement on BOI Injunction, FinCEN Appeal

PCAOB Says Audit Firm Culture is Tied to Audit Quality

PCAOB Punishes New York Audit Firm, Three Partners for Deceiving Inspection Staff

Florida CPA gets 1yr in prison for role in foreclosure scheme

A Florida was sentenced on Friday to serve a year and a day in prison for his role in a foreclosure rescue scheme that victimized desperate homeowners on the brink of losing their homes, the Justice Department announced. Coombs was sentenced by U.S. District Judge Kenneth A. Marra in the Southern District of Florida.

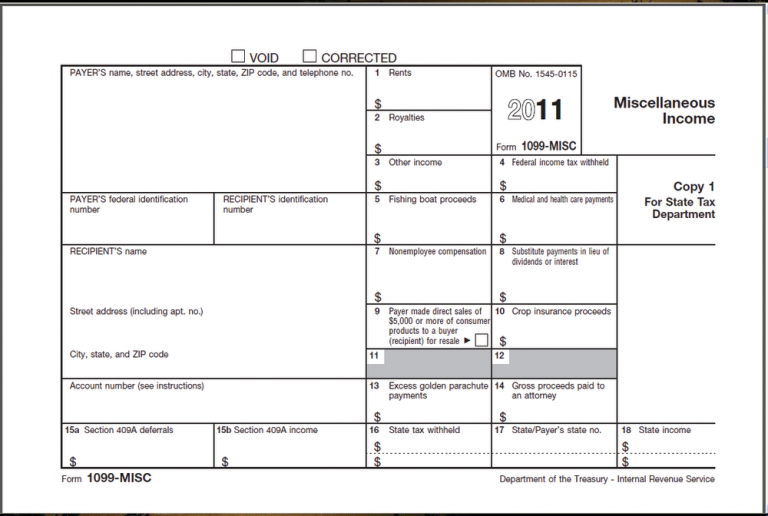

Tips for Navigating 2012 W-2 & 1099 Changes

Avoid penalties, improve compliance and know the important changes for the 2012 year-end

Blackbaud Index Shows Charitable Giving Down

The most recent Blackbaud Index of Charitable Giving shows that charitable giving decreased 3.8% for the three months ending October 2012 as compared to the same period in 2011.

Fiscal cliff makes 2012 a challenge for tax planning

In more than 35 years as a certified public accountant, Greg Sevier said this year has probably been the most challenging one in which to do tax planning for clients.

CPA gets 4.5 year prison sentence in fraud case

A certified public accountant and purported outside auditor for Provident Capital Indemnity Ltd. was sentenced in Richmond, Va., to 54 months in prison for his role in an approximately half-billion-dollar fraud scheme that affected more than 3,500 victims throughout the United States and abroad

W-2 and 1099 Programs Make Year-End Reporting Easier

Every year, tax and accounting professionals and their clients are faced with the often daunting task of year-end wage and information reporting.

Ever-Changing Tax Laws Require Professional Research Solutions

As changes are made to tax laws and technology, the business owners interact with their customers and tax and accounting professionals change. Many tax professionals find themselves moving from the role of tax return preparer to year-round consultant.

2012 Review of BNA Tax & Accounting Center and Financial Resource Center

Bloomberg BNA, Inc. — Bloomberg BNA Tax & Accounting Center and Financial Resource Center800-372-1033www.bna.com From the Dec. 2012 review of tax research systems. Best Fit: Tax, accounting and legal professionals who want up-to-date tax law content, news and analyses. Strengths Complete integration of primary source documentation with Bloomberg BNA portfolios, which are written by experts […]