Taxes

Latest News

IRS-CI Releases Its FY 2024 Highlight Reel

AICPA Releases Statement on BOI Injunction, FinCEN Appeal

PCAOB Says Audit Firm Culture is Tied to Audit Quality

PCAOB Punishes New York Audit Firm, Three Partners for Deceiving Inspection Staff

IRS adds Tumblr to its social media – already on Twitter, Facebook, others

Guess who's the "Mayor of Taxland?" Well, it isn't the Internal Revenue Service, because they aren't on FourSquare, but they are on most of the other popular social platforms.

Chicago accountants, brothers, get prison for $5M sales tax scam

Two Chicago-area accountants were sentenced Friday to two years of probation each after pleading guilty to helping eight gas station owners underreport their sales to avoid paying more than $5 million in sales taxes.

Accounts of KeyBank customers breached in New York state

More than two dozen KeyBank card users, mostly from the New York town of Tonawanda and a few from Amherst, have had their accounts breached, according to local police, in what may be the latest round of fraud stemming from a breach at a prominent local fast-food restaurant.

Bar owner charged with tax evasion & fraudulent wage reporting

The charges claim that between January 1, 2006 and April 15, 2007, he spent more than $533,000 on "personal expenses" on a credit card, but only had reported income of $188,000.

Ohio CPAs to prepare tax returns free of charge for deployed troops

Operation CPA eases the burden on military families during tax season

4 Specialty Tax Tools That Help Fill Niche Needs

The good news is that Congress finally passed tax and budget legislation on the first day of the year. While the deal seems to have left people on both sides of the political aisle less than satisfied, at least tax professionals and taxpayers now know what they rules will be for TY 2013. That may […]

New Year, New Law, New Long-Term Plan

Illinois CPA Explains How the Fiscal Cliff Deal Can Help with Long-Term Planning

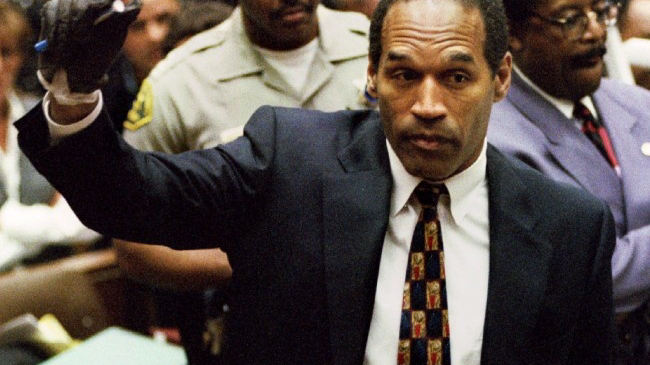

IRS seeks back taxes from O.J. Simpson… so does California

O.J. Simpson may be in prison, but the IRS still has him in it's sights. The tax agency has filed a lien against his earnings claiming he has a debt of $17,015.99 for taxes owed in 2011. Without comment on the 99 cent part of the debt- how was O.J. liable for that tax debt in 2011, since he's been in jail since 2007?