Taxes

Latest News

IRS-CI Releases Its FY 2024 Highlight Reel

AICPA Releases Statement on BOI Injunction, FinCEN Appeal

PCAOB Says Audit Firm Culture is Tied to Audit Quality

PCAOB Punishes New York Audit Firm, Three Partners for Deceiving Inspection Staff

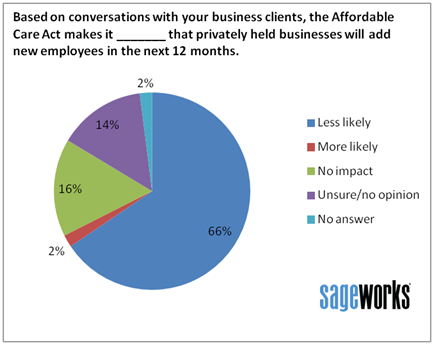

Survey says healthcare law will make hiring less likely at small businesses

The Affordable Care Act, aka ObamaCare, is decreasing the likelihood that businesses will hire new employees, according to a new survey by Sageworks, a financial information company.

Prestigious New York accounting firms announce merger

Effective August 1, 2013, the long established highly regarded firm of Schoenfeld Mendelsohn Goldfarb LLP (“SMG”) has merged into the firm of Janover LLC with offices in Garden City and Manhattan, New York.

Church business manager pleads guilty to embezzlement

A former church business manager facing jail time for embezzlement justified his actions because he felt slighted over a smaller-than-expected bonus, a prosecutor told a judge Friday.

Back to school shopping is a $72 billion business for retailers

Parents Will Spend an Estimated $72.5 Billion This Year for School Supplies

What to do if your client received an erroneous CP2000 notice in July

The IRS miscalculated interest on proposed taxes and will send more notices

Thousands of tax professionals petition IRS on end of e-Services tools

Petition started by Beyond415 urges the IRS to reconsider its decision to retire two e-Services tools.

IRS selects CCH to provide sales tax rates and tables

CCH has been selected by the Internal Revenue Service (IRS) to deliver comprehensive sales tax rate and taxability tables to help millions of Americans prepare their tax returns.

FEMA, SBA extend deadline for Oklahomans to apply for disaster assistance

The deadline to apply for disaster assistance from the Federal Emergency Management Agency has been extended to August 19 as the amount of FEMA dollars approved in Oklahoma disaster areas topped more than $12.2 million Monday.