Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Student Loan Forgiveness Website Opens

The U.S. Department of Education has officially launched a website accepting applications for student loan forgiveness.

Rydoo and Blue dot Partner to Provide Tax Automation Solution for Corporate VAT and Employee Benefits Reclaim

The partnership offers an AI powered solution empowering Rydoo customers with unprecedented visibility and control within the Rydoo workflow,

Surgent Accounting & Financial Education Presents Two New Online CPE Courses

One course examines how the Inflation Reduction Act (IRA) impacts auto- and energy-related tax credits, and the other covers the effects of the new Student Debt Relief Plan on individuals and employers.

How IRS Changes Impact the Tax and Accounting Profession

The IRS is about to expand by hiring 87,000 more agents via the newly signed into law Inflation Reduction Act.

IRS Sending Letters to 9 Million Americans Still Eligible for Stimulus Payments, EITC, and Child Tax Credits

The IRS is sending letters to more than 9 million individuals and families who appear to qualify for a variety of key tax benefits but did not claim them by filing a ...

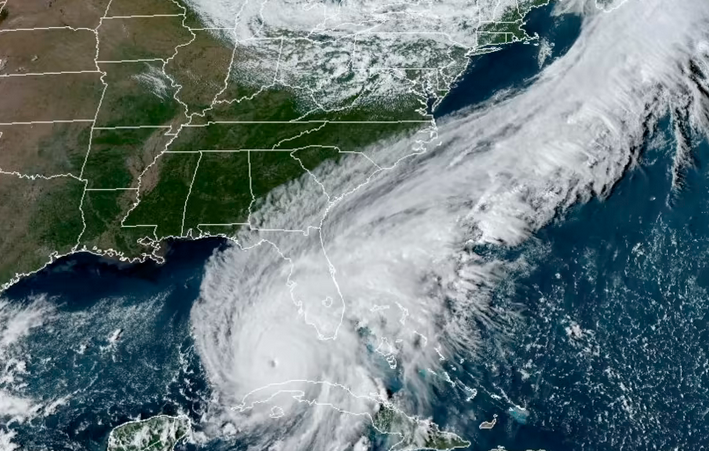

Hurricane Ian and Taxes: How CPAs and Tax Pros Can Help Their Clients

With the IRS providing tax relief for victims of Hurricane Ian, CPAs and other advisors are likely to get hit with questions. Here’s everything you need to know to help your impacted clients get the financial relief they need.

EY Announces Appointment of Kevin Flynn as Americas Vice Chair of Tax

Flynn is based in San Francisco and will oversee tax strategy and all client services, leading a group of more than 18,000 people across Canada; the United States ...

Locking in the Tax Exclusion for QSBS

The tax break for QSBS has been kicking around for a bunch of years and has gone through several iterations.