Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

If I Were the IRS Commissioner…

If the IRS were to change its filing dates so that 1/12 of the taxpayers had tax returns due each month, instead of 100% of the taxpayers having tax returns due in the same month...

Treasury Sets Tight Deadline for Getting Out Guidance on Inflation Reduction Act Tax Provisions

Before year’s end, Treasury said it will release information on the tax provisions contained in the legislation.

House Ways and Means Votes to Release Trump’s Tax Returns to Public

Exactly when and how six years of the former president’s tax information will be released remains unclear.

Suspected Digital Holiday Shopping Fraud in U.S. Increases 127%

18% of e-commerce transactions between Nov. 24 and Nov. 28 in the U.S. were suspected to be fraudulent.

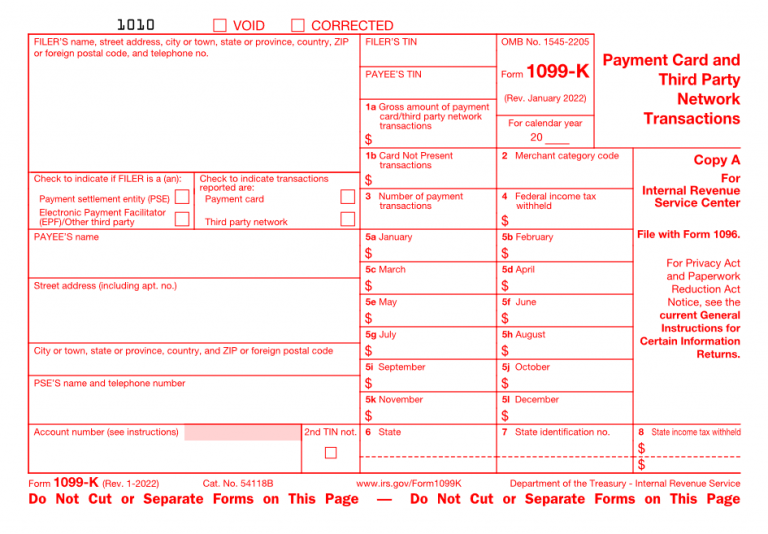

IRS Says Early Tax Filers Should Wait and File Later in 2023

The word of caution from the IRS comes due to a change in how the tax agency issues 1099-Ks.

IRS Puts Out Guidance on New Sustainable Aviation Fuel Credit

It applies to a qualified fuel mixture containing sustainable aviation fuel for sales or uses in calendar years 2023 and 2024.

Sam Bankman-Fried Prepared to Be Extradited to U.S. as Soon as Monday

The disgraced FTX co-founder is expected to disclose in court today that he won’t fight extradition.

AICPA Says $600 Threshold for 1099-K Reporting is Too Low and Outdated

The $600 threshold is based on a threshold established by the Internal Revenue Code section 6041 established in 1954 and does not account for increases in ...