Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

![tax-refund1_10916239[1]](https://stage-cpapracticeadvisorsite-firmworks.content.pugpig.com/wp-content/uploads/sites/2/2022/07/36076/tax_refund1_10916239_1_.5e09733c8f20a-768x439.png)

2023 Tax Refund Dates – Find Out When You May Get Your IRS Tax Refund

The below chart shows an estimated timeline for when a taxpayer is likely to receive their refund, based on the information we have now, and using projections based on previous years.

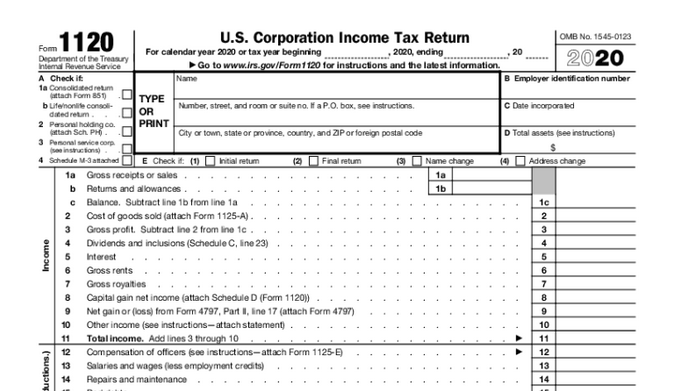

How to Prepare for the Corporate Minimum Tax

A corporate alternative minimum tax (CAMT) will apply to certain corporations reporting more than $1 billion in annual adjusted book income averaged over a three-year period...

IRS Corrected 14 Million Tax Returns with Average Refund of $1,232

Many of the 12 million refunds come from a change in the way unemployment insurance was taxed.

Rescinding IRS Funding Among the Many Bills House Majority is Itching to Pass

The first bill in the GOP package aims to rescind the increased funding for the IRS in the Inflation Reduction Act.

![2018_SurePrep_Logo.5b858829593b3[1]](https://stage-cpapracticeadvisorsite-firmworks.content.pugpig.com/wp-content/uploads/sites/2/2022/07/35740/8_SurePrep_Logo.5b858829593b3_1_.5dd6bd904beee-768x432.png)

Thomson Reuters Completes Acquisition of SurePrep, LLC

SurePrep will become part of Tax and Accounting Professionals operations, with revenues in both Tax & Accounting Professionals and Corporates.

Avalara Appoints Kimberly Deobald as Chief Revenue Officer and Announces New Executive Team Members

She has led customer success, partnership, and sales teams for technology companies, including several roles at IBM.

Help Your Startup Clients Avoid These 7 Tax Mistakes

As trusted advisors, CPAs have the knowledge and expertise to provide our clients with accurate and timely advice on a wide range of tax and financial matters.

11 Men Indicted in Multimillion-Dollar Sports Betting Ring Tax Evasion Case

The sports betting organization they managed evaded tens of millions of dollars in excise taxes for three years.