Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Congress Mandates that Marketplaces Monitor High-Volume Sellers

Marketplace facilitators are being required to monitor and vet high-volume marketplace sellers in a growing number of states, including Arkansas, California, and Oklahoma.

Tax Season Best Practices to Avoid Identity Fraud – 2023

To fight identity fraud and cybercrime, tax preparers and filers must collaborate and adopt effective methods to secure their data and financial resources.

AICPA Wants Congress to Extend Sec. 174 R&E Expensing, Other Expired Tax Provisions

The AICPA supports the deferral of IRC Section 174 amortization requirement of the research and experimental expenditures and requests that Congress retroactively extend the effective date to ...

VARC Solutions Helps Clients Outsource Sales Tax Compliance

Initially focusing on bookkeeping and payroll services, VARC Solutions has expanded to offer fully outsourced business management, payment processing, invoice management, consulting, implementation, and training.

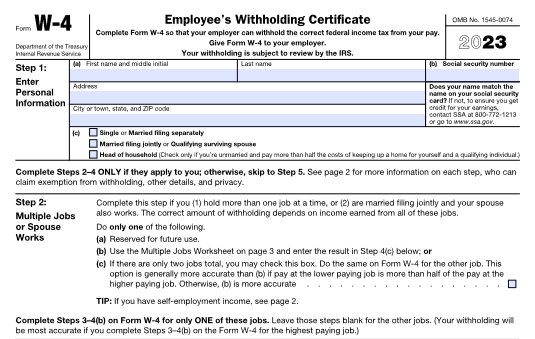

IRS Makes Minor Changes to 2023 W-4 Form

If you know Form W-4 like the back of your hand, knowing these 2023 changes should be enough to close out this article and go about your day.

New Guidance for IRS Solar Tax Credit Program for Low Income Communities

This guidance applies to owners of certain solar and wind facilities placed in service in connection with low-income communities that are eligible for the section 48 energy investment credit.

Changes Coming to IRS Compliance Assurance Process Program

The CAP program began in 2005 as a way to resolve tax issues through open, cooperative and transparent interactions between the IRS and taxpayers before the filing of a return.

IRS Announces Interest Rates for Q2 2023

Under the Internal Revenue Code, the rate of interest is determined on a quarterly basis. For taxpayers other than corporations, the overpayment and underpayment rate is the federal short-term rate plus 3 percentage points.