Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

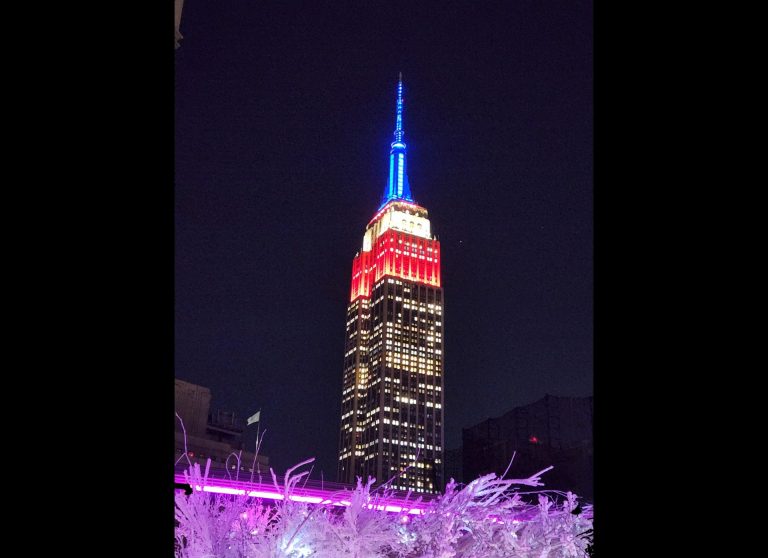

State CPA Societies in Action: New York State Society of CPAs

The NYSSCPA offers networking opportunities for CPAs, along with CPE courses and conferences, over 50 committees that cover various specializations, and also publishes the CPA Journal.

IRS Sets Initial Guidance on NFTs

The IRS and the Treasury Department are leaning toward treating NFTs as a collectible for tax purposes.

Paychex Charitable Foundation to Donate $1 Million to Mental Health America

The grant focuses on improving access to mental health education and resources in the company’s key markets across the U.S.

401(k)s Are Now Open to More Part-Time Workers

The 401(k) plan is one of the most popular qualified retirement plans around. However, in the past eligibility was generally restricted to an employer’s full-time employees.

New Tax Law Boosts ABLE Accounts

If you meet the tax law requirements and are receiving Supplementary Security Income (SSI) and/or Medicaid benefits, you’re automatically eligible to participate.

IRS, Treasury Let U.S. Semiconductor Chip Makers Know How to Claim Tax Credit

Tax incentive looks to boost the making of semiconductors and semiconductor manufacturing equipment in the U.S.

What’s a $100,000 Salary Worth Across America

SmartAsset used its paycheck calculator to apply taxes to an annual salary of $100,000, and adjusted the amount for the local cost of living, including housing, groceries, utilities, transportation and other goods and services...

The Tax Blotter – March 2023

Many of the changes for individuals in the Tax Cuts and Jobs Act (TCJA) are temporary and are scheduled to expire after 2025. But some are permanent provisions of the tax code.