Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

IRS Incorporates AICPA Recommendations in Strategic Operating Plan

The spending plan includes goals and timetables covering areas such as operations support, enforcement, taxpayer services and IT modernization.

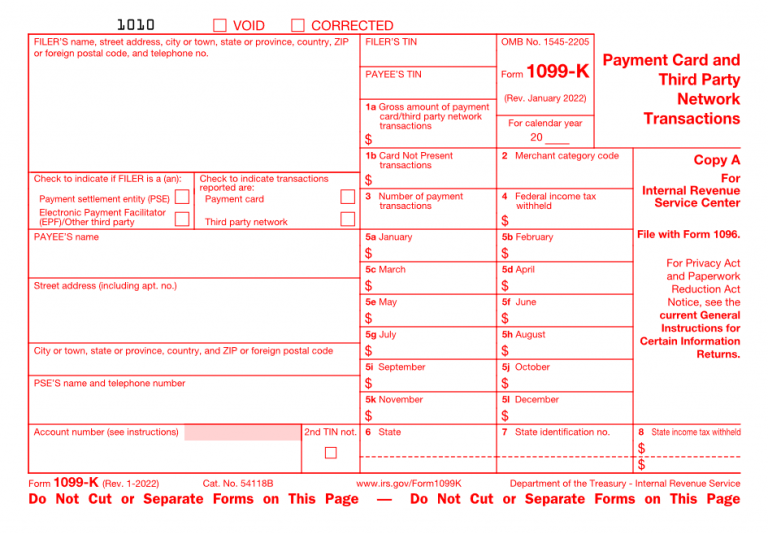

Here’s All of the 1099 Form Types, From A to SB

The IRS lists 21 different 1099 forms. Here is an overview of each form, as of March 2023, and why you could receive one.

Five Benefits of Hiring Your Spouse

When you officially add your spouse to the company payroll, they are taxed on the compensation, but are also eligible for benefits just like any other employee.

Lodging Tax Insanity — So Many Ways to Tax Accommodations

No matter how big an accommodation platform provider is, complying with state and local accommodation tax requirements can quickly become a burden.

Colorado Mulls Simplifying Retail Delivery Fee Requirements

The 27-cent retail delivery fee applies to all deliveries containing at least one taxable item that are made by motor vehicle to a location in Colorado.

2023 IRS Tax Refund Calendar – When Will You Get Your Refund?

The IRS says most e-filed tax refunds are direct deposited into taxpayer bank accounts in as little as 10 days, so why pay to get your refund?

Indiana Owner of D.C.-area Tax Preparation Business Pleads Guilty to Tax Refund Fraud Scheme

From 2012 through 2016, Tedla and her coconspirators prepared and electronically filed with the IRS fraudulent returns on behalf of clients and illegally-obtained identities of unwitting taxpayers

Justice Department Continues Efforts to Stop Fraudulent Tax Preparers

Unscrupulous preparers who include errors or false information on a tax return could leave a taxpayer open to liability for unpaid taxes, penalties and interest.