Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

AICPA Recommends Improvements to Regulations on Section 645, Election to Treat Trust as Part of an Estate

TD 9032 describes the procedures and requirements for making an election to have certain revocable trusts treated and taxed as part of an estate.

Arizona Tax Preparer Accused of Drug Smuggling Now in Trouble for Tax Fraud

Nour Abubakr Nour was indicted by a federal grand jury and accused of filing fraudulent tax returns to reap inflated fees.

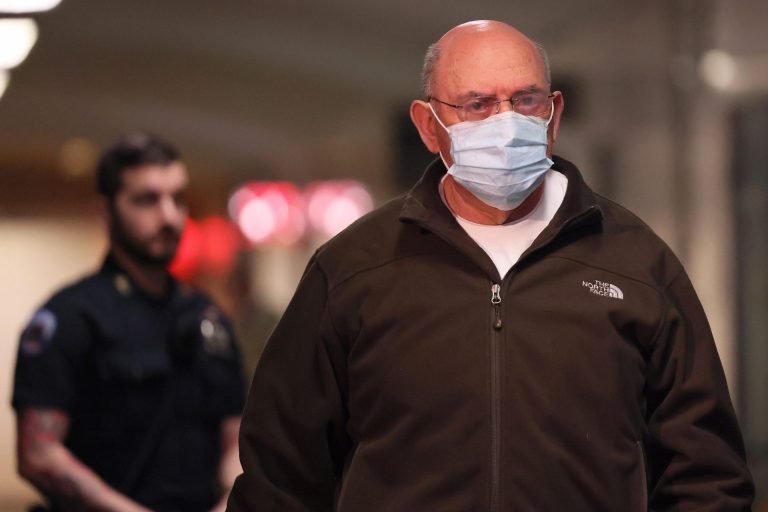

Trump CFO Allen Weisselberg Released From Jail After 100 Days For Tax Fraud

Donald Trump’s longtime moneyman, convicted of criminal tax fraud last August, was sprung from Rikers Island.

3 Ways the IRS is Making it Easier for Small Business Owners to Do Their Taxes

Interacting with the agency should be less painful over the next decade as the IRS’s $80 billion spending plan is implemented.

Biden Taxes Show Income of $580,000 in 2022

The Bidens were responsible for $169,820 in combined federal, Delaware, and Virginia income taxes last year.

What Small Business Owners Need to Know About Crowdfunding and the IRS

Before launching a campaign, make sure you understand all of the tax implications of crowdfunding.

‘IRS is Finally Answering the Phones’ But Tech Problems Persist

While IRS customer service is getting better, the agency is prone to stumble, particularly when technology is involved.

Just 10 Electric Vehicles Qualify for Full $7,500 U.S. Tax Credit

GM, Tesla, and Ford all have at least one EV that qualifies, while Ford and Stellantis have one eligible plug-in hybrid model.