Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Instead Pro from Corvee – 2024 Innovation Award Finalist

Instead Pro from Corvee was a Finalist for the 2024 Tax and Technology Innovation Awards, from CPA Practice Advisor.

Taxbit Rolls Out 1099-DA Support

Taxbit's scalable platform is designed to adapt to the evolving complexities of digital asset reporting, the company said Aug. 27.

Why Bill Belichick Thinks ‘Taxachusetts’ Deters Free Agents From Joining Patriots

The ex-New England Patriots coach says Massachusetts' additional 4% surtax on taxable income over $1 million hinders the team.

Are Your Clients Compliant with Tangible Personal Property Taxes?

Almost every state has rules about the taxability of goods and services, and the complexity of those rules affects a lot of business owners and CFOs daily. But a tax on tangible personal property can be just as confusing.

Opinion: Trump and Harris Proposals Would Make Our Tipping Culture Worse

Plans to exempt tips from federal income taxes would be bad news for customers—and perhaps even for tipped workers themselves.

1 in 3 Borrowers Have Slowed Student Loan Repayments, Survey Finds

Some borrowers may be forgoing the proper channels and stopping repayment entirely in hopes of student loan forgiveness.

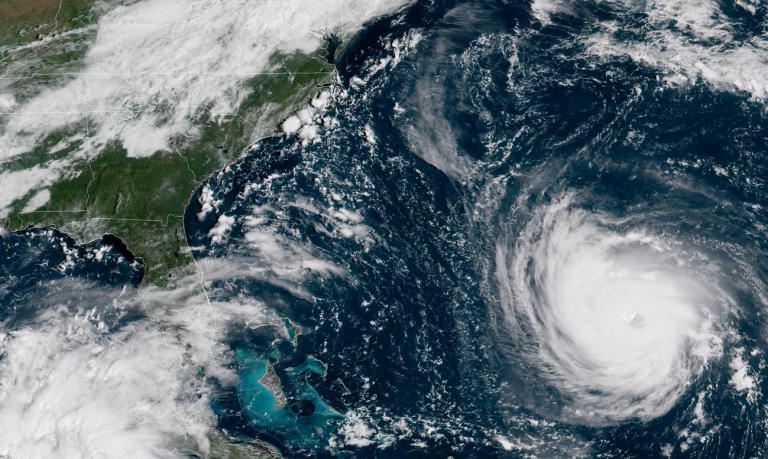

U.S. Taxpayers in Puerto Rico Get Relief Due to Tropical Storm Ernesto

These taxpayers now have until Feb. 3, 2025, to file various federal individual and business tax returns and make tax payments. The IRS is offering relief to any area designated by the Federal Emergency Management Agency (FEMA).

Why Sales Taxes Are Often Different for Takeout, Delivery and In-Restaurant Food

Sales tax typically applies to both dine-in and takeout food in Colorado, Florida, Indiana, Kentucky, New York, Texas, and Wisconsin, at least if it’s from a restaurant.