Tax Planning

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Donald Trump Revises IRS Tax Reform Plan

Trying to reclaim some momentum in his presidential election campaign, Donald Trump, the Republican candidate, is tweaking his tax plan. In a far-ranging speech on economic policies on August 8, Trump proposed cuts in individual tax rates, although not as drastic as in previous proposals. The billionaire also advocated tax reforms in line with the […]

Prince and a Lesson on Estate Planning … Have A Will or Trust

In the wake of the entertainer Prince’s death, it has been called “the worst estate planning sin a wealthy artist could commit: leaving no will at all.”

How to Calculate the Taxable Amount of an IRA Withdrawal

One of the issues that often causes a high degree of client confusion is whether or not a withdrawal from their IRA account will be taxable, and if so, to what extent.

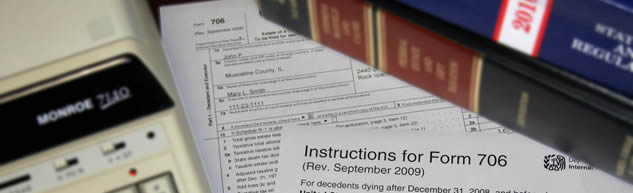

AICPA Wants Changes to IRS Estate Tax Form and Instructions

The American Institute of CPAs (AICPA) has submitted comments to the Internal Revenue Service (IRS) and U.S. Department of the Treasury about IRS draft Form 8971, Information Regarding Beneficiaries Acquiring Property from a Decedent, and draft ...

Bernie Sanders’ Tax Plan Incudes Big Tax Hikes For High Income Americans

The figure that is likely to grab your attention is 52 percent. That is the top tax bracket proposed by Sanders, a plateau that hasn’t been reached since a watershed 70 percent rate was scaled back in the 1980s. The top tax bracket peaked at 91 percent...

Special Report Focuses on Year-End Tax Laws and Other Key Developments

Thomson Reuters has released a special report highlighting key tax developments in 2015 to aid practitioners in 2015 tax return preparation and support 2016 planning.

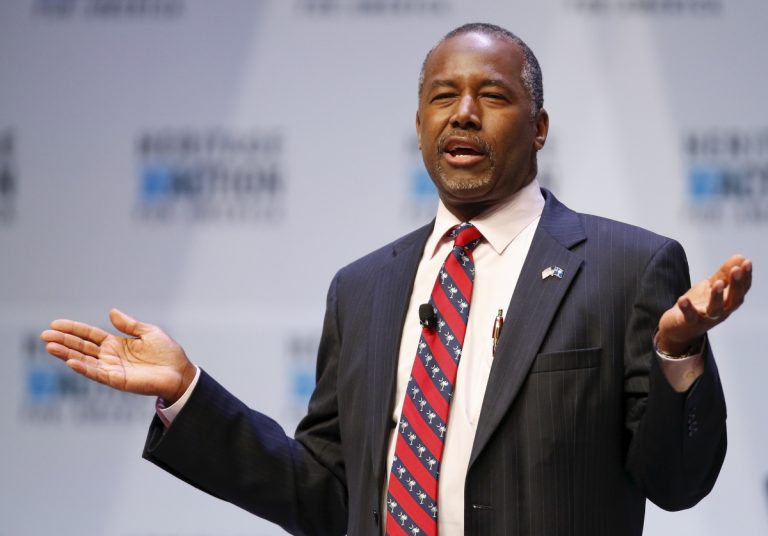

GOP Candidate Ben Carson Builds on Flat Tax Platform

Carson would also eliminate deductions for charitable contributions, mortgage interest and state and local income taxes, while repealing the alternative minimum tax (AMT), the earned income credit and the rules for depreciation.

AICPA Says New IRS Policy On Estate Closing Letters Is Innefective

The American Institute of CPAs (AICPA) has submitted comments to the Internal Revenue Service (IRS) about the IRS’s new policy of issuing estate tax closing letters only upon a separate request four months after filing the estate tax return. The IRS announced changes related to the issuance of estate tax closing letters on the […]