State and Local Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

The Best and Worst States for Taxes in 2015

The Multistate Tax Foundation (MTF) recently issued its 2015 State Business Tax Climate Index report, a benchmarking report that enables state governments and others to compare their tax systems with other states. Ideally, those states that rank ...

How to Avoid or Even Take Advantage of the Alternative Minimum Tax (AMT)

[This is part of a special series of articles designed to maximize tax benefits and minimize tax pitfalls at the end of the year.] The alternative minimum tax (AMT) is often referred to as a “stealth tax” because it sneaks up on unsuspecting taxpayers. But you’re not doing your job well if your clients are caught […]

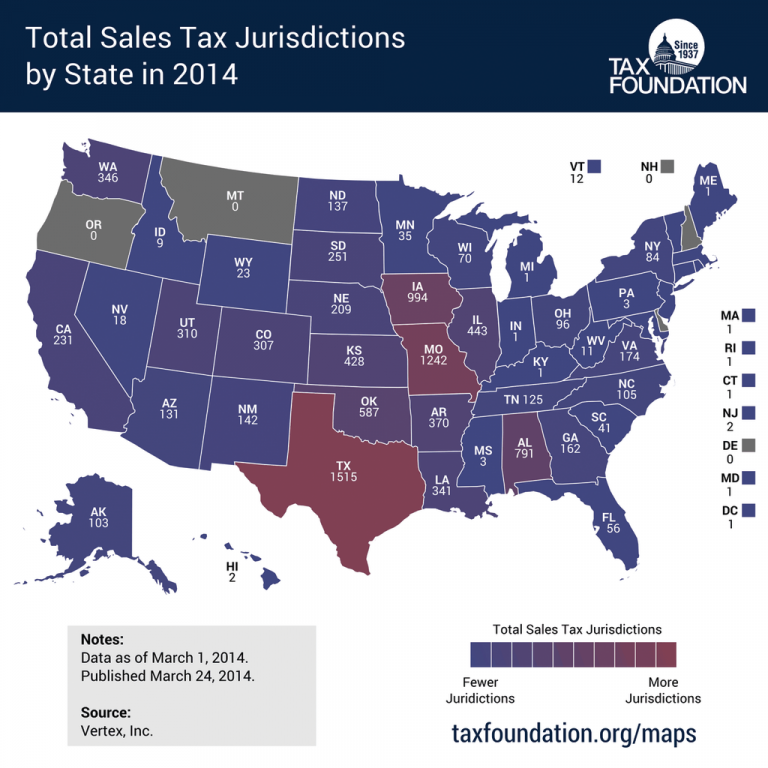

How Does the Marketplace Fairness Act Affect Use Taxes?

While almost everyone has heard of sales tax, many business owners are unaware that most states have a “use tax.” State laws treat sales and use tax as two separate taxes, but in reality they act in concert to complement each other.

5 Networking Tips for State and Local Tax (SALT) Practitioners

You probably know the income, sales, and use tax rules in your own state and local jurisdictions without having to do much research. But what if a new client walks in the door and presents you with a tax situation in a state where you have not practiced b

Sales Tax Software Company Receives Patent

A Northwest Arkansas software company earlier this month received one of only 15 sales tax-related patents ever issued by the U.S. Patent and Trademark Office.

How to Prepare for a Sales Tax Audit

The sales and use tax audit could possibly be one of the biggest challenges that your business clients will face. If you are working with a client who has been selected for an audit, you are now tasked with proving that the client remitted the correct amount of sales tax to the state Department of Revenue (DOR) agency. You will gain confidence about the pending sales tax audit if all documents have been prepared properly. The following tips will help you better prepare for the dreaded sales tax audit.

Are Your Clients Likely to Face a SALT Audit?

Historically, a business' gross revenues follow seasonal patterns and even a small change in gross revenue should result in a small change in the associated accounts. In an attempt to discover why one established contractor was selected for audit, I reviewed their sales tax filings and created the below table.

Wisconsin Falls $281 Million Short on Tax Collections

State tax collections fell short of expectations by $281 million last year, providing potential difficulties in the future for the state budget and immediate fodder for this fall's tight governor's race.