State and Local Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Despite Snow, Maryland CPAs Turn Out For Legislative Day

Maryland CPAs have chosen to be active participants rather than passive recipients as more than 130 CPAs showed up for the annual CPA Day in Annapolis event hosted by the Maryland Association of CPAs. It was their 115th year advocating for the CPA profess

New Program Helps Accounting Firms Specialize in Sales & Use Tax Compliance

One of the key features of the program, announced here at CPA.com’s Digital CPA Conference, is a single accountant console where firms can monitor client sales and use tax compliance from tax calculation to returns generation and form filing.

State and Local Sales Taxes Increase Across U.S.

The U.S. average combined sales tax rate increased marginally in the third quarter with an increase in the number of indirect tax changes, according to the latest ONESOURCE Indirect Tax report from Thomson Reuters.

Good News For Taxpayers Filing a Non-Resident State Income Tax Return

As it stands now, each state has different thresholds in place for the amount of time an employee must work in the state before needing to file a non-resident tax return. Requirements run the gamut from one day to 60 days, and in some cases, taxation ...

Year-End Insights for State and Local Taxes

The deduction for taxes claimed on Schedule A includes amounts paid for state and local income taxes such as the taxes withheld from your paychecks and any estimated taxes paid during the year. It also includes property taxes if you’re a homeowner.

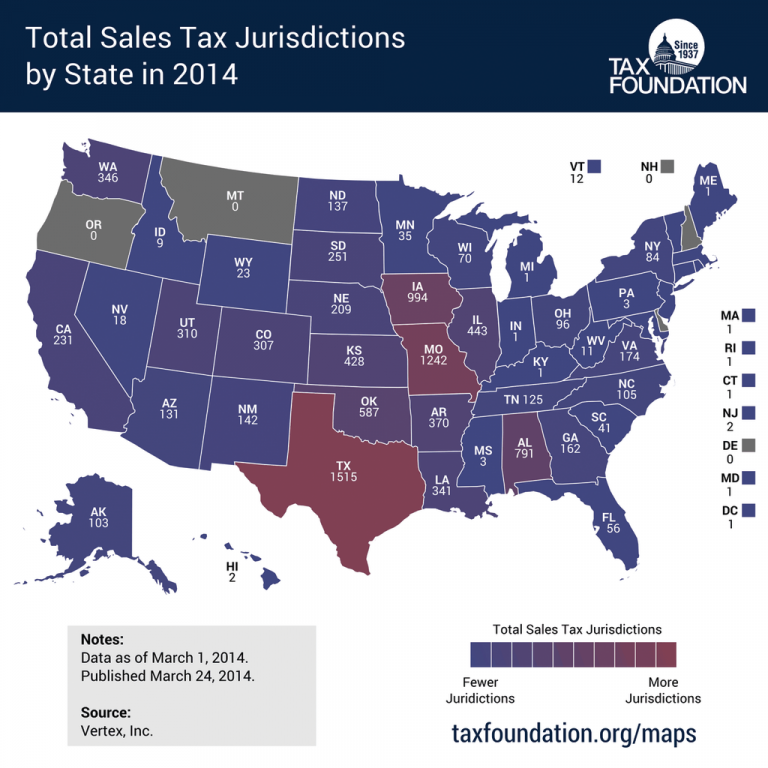

CPA.com Partners with Vertex SMB for Sales Tax Solutions

Businesses that sell online or operate in multiple states can find it daunting to stay compliant with ever-changing regulations from a host of jurisdictions and taxing authorities. Vertex SMB’s tax calculation and returns platform helps CPA firms and ...

Avalara Offers First Ever Guarantee on Sales Tax Calculations

Avalara has just announced it will guarantee the accuracy of its sales and use tax calculations. Avalara is the first in its industry to offer such a promise. The company makes cloud-based solutions for sales, use, VAT and other transactions.

New Version of Bloomberg BNA Tax Managment Portfolio Analyzes Trends in Unclaimed Property Laws

Bloomberg BNA has released a new edition of Unclaimed Property, its Tax Management Portfolio providing in-depth analysis and practical insights from prominent practitioners on escheatment and unclaimed property laws.