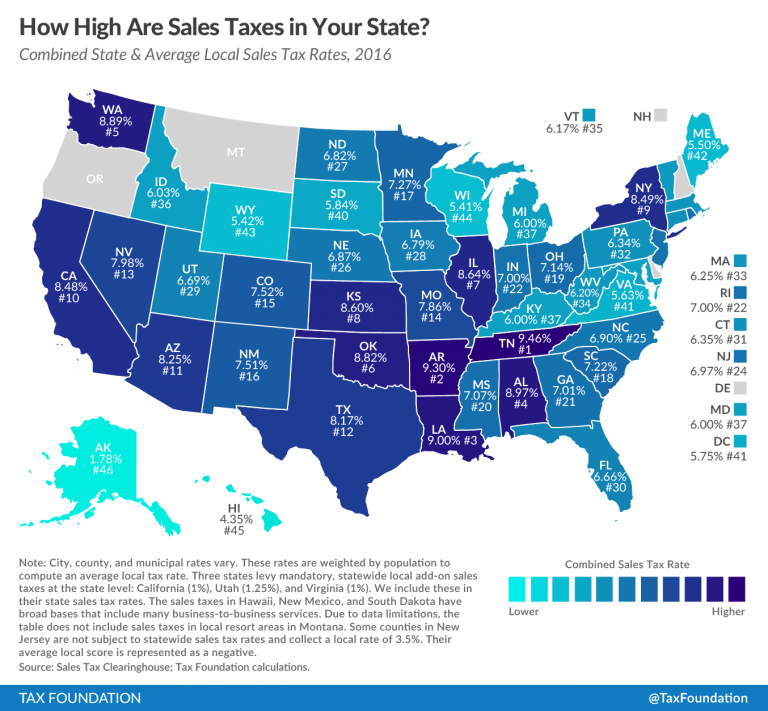

State and Local Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

2016 Review of BNA Sales Tax Rates

BNA Sales and Use Tax Rates and Sales and Use Tax Forms are both available online for easy anytime/anywhere access. With the ability to support multiple business entities, both products are truly designed for the tax professional, though businesses ...

2016 Review of Avalara TrustFile

TrustFile from Avalara, is an ideal fit for small businesses and e-commerce merchants looking for an automated way to process, fill, and file tax forms for all 50 states. TrustFile works closely with AvaTax to calculate accurate sales and use tax ...

2016 Reviews of Sales and Use Tax Systems

With the complicated rules, and the inordinate amount of time it would take today’s business owner to research and implement tax rates for cities, counties, states, and even countries, it’s imperative that today’s business owners invest in a software ...

States Could Improve Business Tax Compliance By Sharing Data

Business tax non-compliance is a problem that plagues states across the U.S., but could be improved if states were able to more easily share data, according to new research by the Governing Institute. The survey of tax and revenue officials across 29 ...

State Tax Nexus Getting More Complex

The state tax arena is fraught with variation, complexity, confusion and ambiguity, which has major implications for U.S. corporations, according to findings from Bloomberg BNA’s 2016 Survey of State Tax Departments, conducted for the 16th consecutive ...

New Guidance Focuses on Puerto Rico VAT

This coverage comes at a crucial time. On June 1, 2016, Puerto Rico will become the first U.S. jurisdiction to adopt a VAT to replace its sales and use tax regime. The transition to this new scheme began in 2015 and has been controversial.

The Sticky Business of Excise and Sales Tax Requirements

There are a variety of industries that find themselves with a unique tax conundrum…they are required to calculate and file both sales and excise taxes to run their day-to-day business. So, what’s the big deal?

February in the SALT Practice: Client Meetings

It's February and you're in the heart of busy season. Starting a new process for organizing and monitoring state and local tax chores and obligations is really not feasible at this point in time, but there are some best practices you can employ that ...