Software

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

3 Tactics to Reduce Tax Season Stress

Tired of 80-hour work weeks? Frustrated that your staff doesn’t want to be held accountable? Stressed about stressing next tax season? As part 1 of a series on “Building your Tax Season,” I wanted to share with you a couple of steps you can take today ...

5 Questions for Nonprofit Leaders

The most valuable assets of any organization with a purpose – whether it’s for-profit or not-for-profit – are its people, and that’s why hiring is so important. When screening candidates, who may become part of your work culture, however, there are ...

Nonprofit Accounting Insights & Analysis Survey Shows Challenges

More than half of nonprofit accounting professionals recently surveyed said they struggle with reporting non-financial performance data. Overall majority don't enjoy the automation of reporting with 73% spending up to 5 hours a week manipulating data outs

Study Shows Top Trends and Challenges for Nonprofit Finance Professionals

Accounting professional who work for, or manage, nonprofit organizations often deal with smaller budgets and smaller staffs than their peers at other organizations, but those aren't the biggest challenges they face.

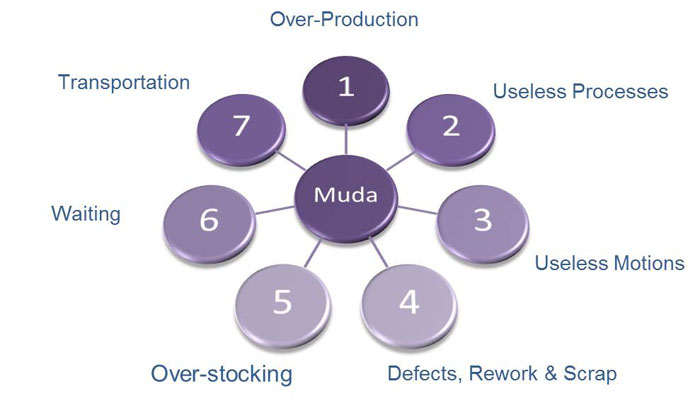

Improve Your Firm’s Tax Production by Eliminating Muda

Eliminating Muda is one of the most effective byproducts of Lean Six Sigma analysis techniques which make any process more efficient and profitable. So what exactly is Muda? It is the Japanese term for waste, which is defined as “any human activity ...

IRS Drops PTIN Fee to $50

The fee for new PTINs and renewals will be $50, down from $64.25 and $63, respectively. The agency also reminded return preparers of major upcoming changes regarding which tax return preparers can represent clients in matters before the IRS.

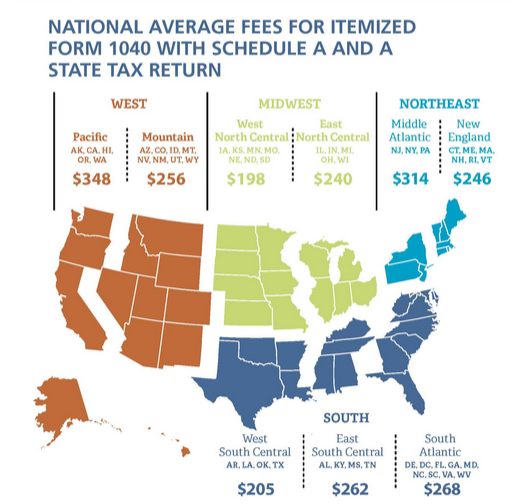

Average Income Tax Preparation Fees Increased in 2015

The average cost of a professional income tax preparer to handle a "typical" 2014 tax return (the one filed by April 15, 2015) was $273 this year. This includes an itemized Form 1040 with Schedule A and a state tax return, according to the National ...

Survey Shows Accounting Firms More Successful When Using Integrated Suite

The survey also identifies the top pressures that firms face now and in the coming year, with recruitment and retention of knowledgeable talent identified as the biggest pressure point.