Small Business

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

![Islands-Group2[1]](https://stage-cpapracticeadvisorsite-firmworks.content.pugpig.com/wp-content/uploads/sites/2/2020/04/Islands_Group2_1_.5e973ed1511e8-768x509.png)

The Rules on Sales Taxes for Food Takeout and Delivery

There’s a lot to learn, and not a lot of time to learn it. The business landscape is changing overnight: Another unknown may be how to handle sales tax on takeout or delivery services.

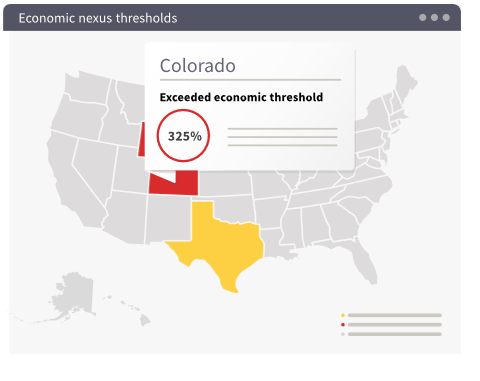

Online Risk Assessment Tool Helps Online Sellers Understand Sales Tax Obligations

Avalara launches the Sales Tax Risk Assessment at a time when businesses, primarily online sellers, are facing added sales tax complexity. The South Dakota v. Wayfair, Inc. ruling in June 2018 stated that given the power and prevalence of the ...

What to Know When Your Clients Want to Expand Their Businesses to Another State

Are your clients looking to expand their businesses to another state or states? If so, that’s a great indication of success and they’ll probably turn to you for financial guidance to help them make the move. However, they’re also likely to need your ...

QuickBooks Capital Approved as Paycheck Protection Program (PPP) Lender

Company preparing to accept applications for billions of dollars in requested PPP relief next week. 1 in 12 American employees is paid through QuickBooks Payroll

IRS Issues CARES Act Guidance for Taxpayers with NOLs

The Internal Revenue Service today has issued guidance providing tax relief under the CARES Act for taxpayers with net operating losses. Recently the IRS issued tax relief for partnerships filing amended returns.

![vena-logo_v1[1]](https://stage-cpapracticeadvisorsite-firmworks.content.pugpig.com/wp-content/uploads/sites/2/2020/04/vena_logo_v1_1_.5e8f34e2823bb-768x401.png)

Vena Solutions Launches Business Planning Quick Start Package

Integrated agile business planning and budget orchestration are critical to business success, now more than ever. As finance and operations teams face seismic uncertainty, Vena Solutions’ Quick Start Package equips professionals so they can start ...

AICPA Applauds Additional Clarity in Treasury FAQ on Paycheck Protection Program

The American Institute of CPAs (AICPA) is thanking the Treasury Department and Small Business Administration (SBA) for providing further clarity on the application process for the Paycheck Protection Program (PPP), the $349 billion small business ...

AICPA Recommends Lender Documents and Key Calculations to Use in PPP Applications

The American Institute of CPAs (AICPA) has recommended a defined set of documents for lenders to rely on as well as some key clarifications in the Treasury Department and Small Business Administration’s Paycheck Protection Program (PPP) application ...