Sales Tax

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Avalara Launches Beverage Alcohol Tax Compliance System

AvaTax for Beverage Alcohol is a central component in the Avalara for Beverage Alcohol suite of products, which provides comprehensive support for beverage alcohol businesses across the compliance life cycle, from licensing and product registrations ...

As States Look to Bounce Back, Tax Leaders Need to Engage with Lawmakers

Transaction tax changes are on pace to reach the second highest total in the past 11 years. 150 city sales tax rate adjustments have occurred to date this year—with all but 10 being rate hikes—and those numbers aren’t likely to slow down.

![Billtrust-logo-full-color[1]](https://stage-cpapracticeadvisorsite-firmworks.content.pugpig.com/wp-content/uploads/sites/2/2020/08/Billtrust_logo_full_color_1_.5f3d42ba947e8-768x144.png)

Billtrust Adds Integration with Avalara CertCapture

By partnering with Avalara, a tax compliance software provider, Billtrust customers will benefit from an automated process to collect, validate, store and manage sales tax exemption certificates, eliminating manual work and creating a ...

Tennessee Lowers Sales Tax Economic Nexus for Online Sellers

Retailers with no physical presence in Tennessee are currently required to collect and remit Tennessee sales tax if their annual sales into the state exceed $500,000. Starting October 1, 2020, out-of-state businesses and marketplace facilitators must ...

Chicago Starts Taxing Wine-by-Mail Orders

As of July 1, 2020, wineries are required to collect Chicago liquor tax on sales made directly to consumers with a Chicago address. This is a significant departure from previous policy: Chicago liquor tax applied only to sales made physically in the city through June 30, 2020. The change to the Chicago liquor tax policy only affects wineries and other wine sellers, because breweries […]

States Searching for Revenue Get Aggressive on Sales Tax Enforcement

Federal, state, and local officials scrambled to support struggling businesses and individuals when the coronavirus (COVID-19) first hit. They placed temporary moratoriums on evictions, pushed income tax due dates to July 15, and waived interest and ...

Avalara Introduces New Capabilities to Help Sellers Manage Cross-Border Tax Compliance

Avalara’s cross-border solution consists of Avalara AvaTax Cross-Border and Avalara Item Classification, providing users with an integrated approach or stand-alone offerings to address the complex processes of classifying products and ...

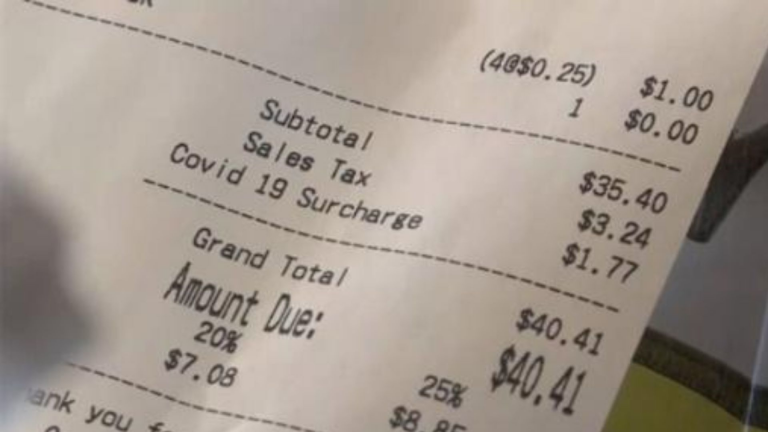

Sales Tax Issues Arise with COVID-19 Surcharges

Business owners, especially restaurants and bars, should anticipate a sales tax audit if they are implementing Covid-related fees.