Payroll

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

SF Mayor Ed Lee: Goodbye Payroll Tax

Live at 2013 LAUNCH Festival, Kym McNicholas talks to Mayor Ed Lee about how to attract and maintain start-ups in San Francisco and California.

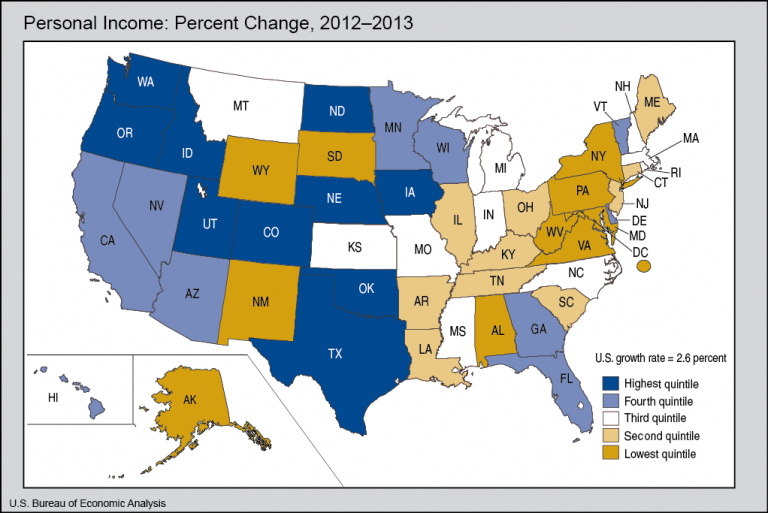

Which States Have the Highest Personal Income Growth?

Average personal income in the United States grew by 2.6 percent in 2013, which is mixed news since that reflects a slowing of income growth from 4.2 percent in 2012. All 50 states and the District of Columbia realized gains in average personal income during the year, according to data from the Bureau of Economic Analysis.

Central California Sees Federal Grants as Key to Job Growth

San Joaquin county officials on Tuesday signed off on an "aggressive" economic development strategy, a necessary step to position the inland and mostly agricultural county's agencies to receive millions of federal grants meant to help spur job growth.

Payroll Services Firm Recognized for Ethics

Paychex has been recognized by The Ethisphere Institute, an independent center of research promoting best practices in corporate ethics and governance, as a 2014 World’s Most Ethical Company.

Treasury Offers Quick Fix on Another Obamacare Glitch

The government seems to have worked out most of the kinks in www.healthcare.gov, the online site used to sign up for Obamacare. But it has yet to address another glitch that surfaced almost two years ago: Language in the law that prevents married taxpayers who file separate tax returns from qualifying for special tax subsidies.

Unions Unhappy with Maine Plan to Attract Business

A component of Governor Paul LePage's plan to attract manufacturers to Maine would violate federal law, labor unions told lawmakers Monday.

Supreme Court: Severance Payments are Taxable Wages for FICA Purposes

The Court ruled that severance packages and payments that are given to involuntarily laid-off workers are taxable not only as individual income, but also with regard to FICA employment taxes. It was a unanimous 8-0 ruling, with Justice Elena Kagan recusing herself from the case. Oral arguments were heard by the court last October.

Should Accounting Firms Sell Health Insurance?

When it first became clear that tax preparers – including CPAs – would have to be the front line in implementation of the Affordable Care Act, I voiced a lot of concerns. I doubted it would be possible for accounting professionals to serve as both trusted advisors and health insurance sales people.