Payroll

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Freelancers Get Tax Help with QuickBooks Self-Employed

Filing taxes can be daunting, especially for those with complicated tax situations, such as small business owners or freelancers. That’s where Intuit’s QuickBooks Self-Employed comes in.

Are Your Clients ACA Ready?

Now that the Affordable Care Act is completely underway, some business owners have found that they are not prepared to ensure compliance, particularly as new changes go into effect and they prepare to file their 2014 taxes.

Regulations and IT Issues Add To Costs for Businesses

Many businesses are wasting valuable resources by maintaining disparate IT systems or using manual processes to remain compliant with laws and regulations governing their workforces, according to a new study released by CFO Research and ADP.

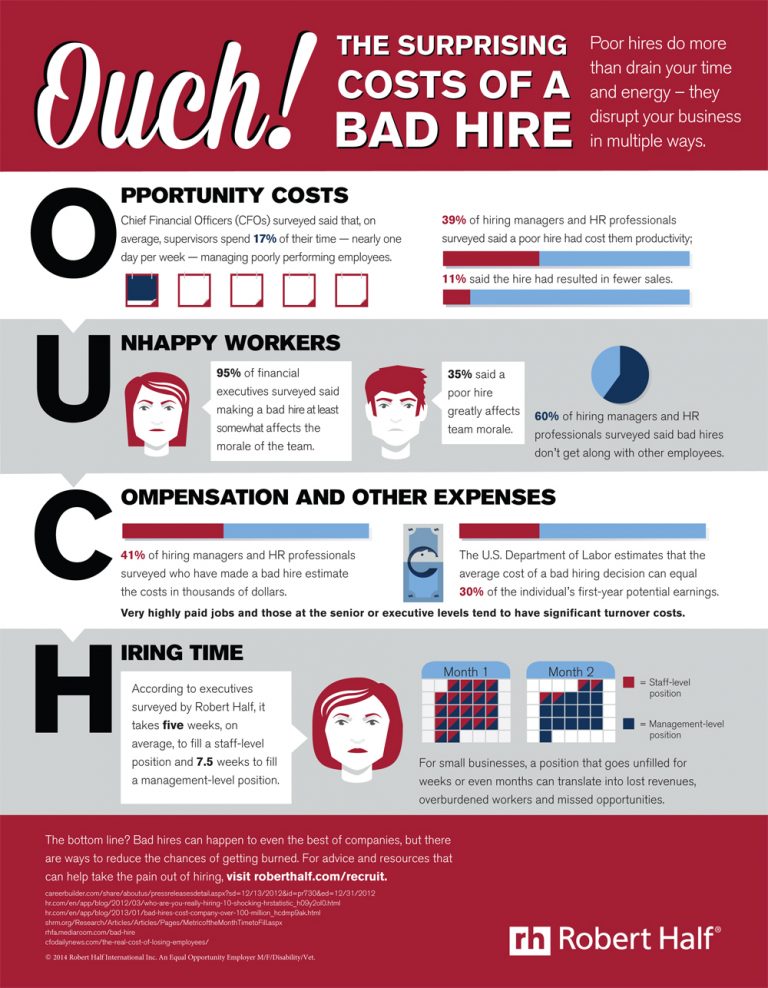

The Cost of a Bad Hire (It’s Not Just Money) – And How to Avoid Bringing One on Board

Making a bad hire can be very expensive to organizations. In fact, research suggests (www.blissassociates.com/html/articles/employee_turnover01.html) replacing an employee who doesn’t work out can cost at least 150 percent of that worker’s salary. Still,

Deltek to Acquire Global Talent Management Provider

Deltek announced today that it has entered into an agreement to acquire HRsmart, a global provider of talent management solutions with over 1,000 customers around the world. This acquisition will broaden Deltek’s portfolio of Human Capital Management (HCM

Ceridian SMB Payroll App

Ceridian’s SMB Payroll app is the first mobile application (mobile app) submission for Ceridian Small Business (SMB) Payroll. The new mobile app enables users to perform their payroll-related tasks using their Android device, instead of having to access a desktop or laptop computer. Only active Ceridian client users can log in to the mobile app […]

The Obamacare Tax Glitch Fallout Continues

About 20 percent of those who bought a health care marketplace plan in 2014 and used tax credits to lower their premiums received faulty information, due to a miscalculation of the premium benchmark amount. Government officials say that these taxpayers wi

Obamacare Tax Glitch Hits 800,000 Taxpayers, Some Must Re-File

About 800,000 HealthCare.gov customers got the wrong tax information from the government, the Obama administration said Friday, and officials are asking those affected to delay filing their 2014 returns.