Payroll

AccountantsWorld Launches Employee Portal App

EPPR is the only app that fully integrates with AccountantsWorld's Payroll Relief platform, the leading cloud-based system designed to enable accountants to offer seamless, end-to-end payroll services to their small-business clients.

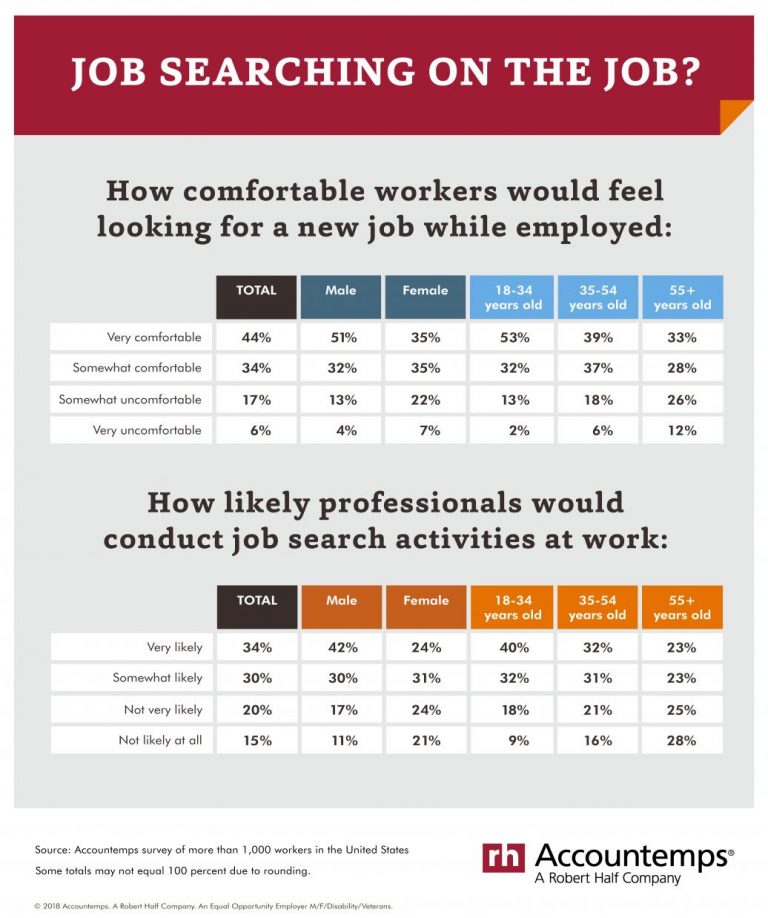

Most Employees Feel OK Searching for a New Job While at Work

Most professionals feel confident testing the employment waters, even from their current office, research suggests. In a survey from global staffing firm Accountemps, 78 percent of workers said they would feel at least somewhat comfortable looking ...

ICE and Your Small Business Clients – Be Prepared

The roar of churning helicopter blades, the flashing of lights on the vehicles of armed local and federal law enforcement agents, blocked roads surrounding the plant, and panicked employees running in all directions, this was the scene recently at the ...

Should Workers Share Their Salary Information?

Overall, just under 1 in 4 Americans (24%) has divulged his or her pay to a coworker. Men are more likely than women to have done so (29% vs. 20%), as well as those with higher income and education levels.

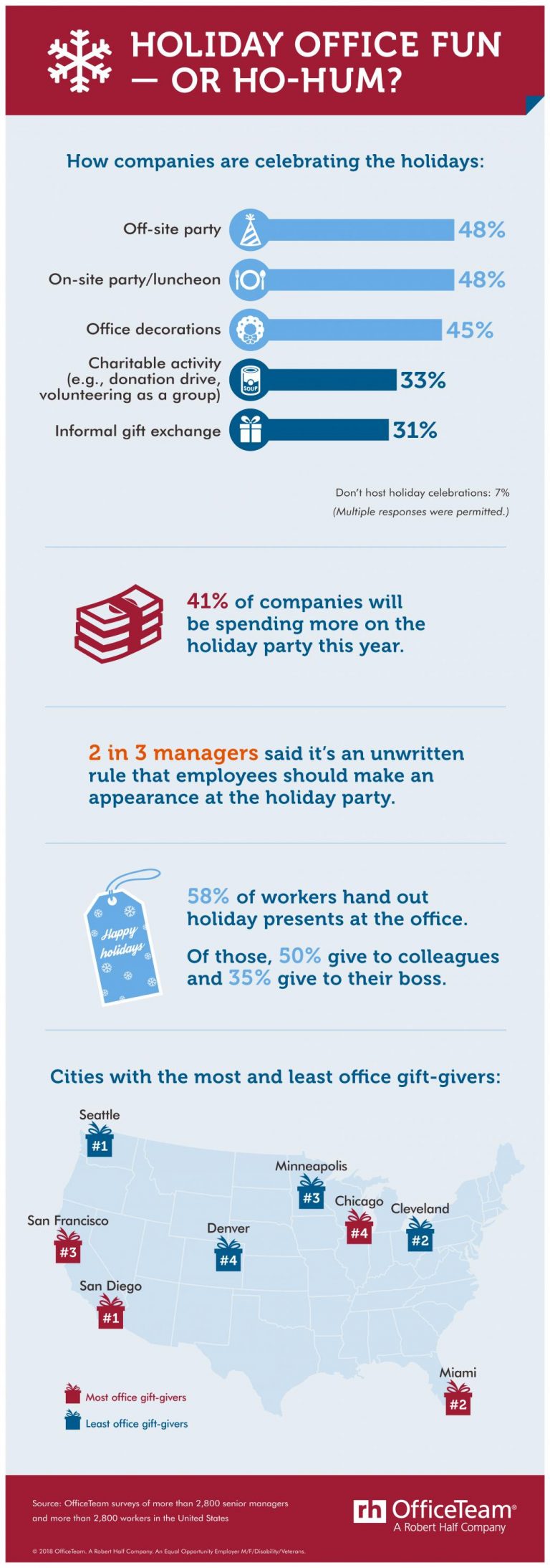

Businesses Increase Budgets for Holiday Parties this Year

How will holiday cheer be spread in workplaces this season? According to new research from staffing firm OfficeTeam, 93 percent of senior managers said their company will be hosting year-end festivities. Of those who noted holiday activities are ...

OnPay Offers New Payroll Partner Program for Accountants and Bookkeepers

OnPay has introduced its Partner Program. The OnPay Partner Program adds powerful new features to the company’s award-winning payroll software.

What Businesses Need to Know About the FMLA Tax Credit

While large employers must provide protected leave, FMLA does not require that FMLA leave be paid, although most employers coordinate FMLA leave with their paid-time off policies. The recent tax reform provisions have created a potential silver lining.

![569175-gusto-logo[1]](https://stage-cpapracticeadvisorsite-firmworks.content.pugpig.com/wp-content/uploads/sites/2/2022/07/32088/569175_gusto_logo_1_.5df291e896a94-768x432.png)

ScaleFactor Partners with Gusto for Payroll and HR

Gusto serves more than 60,000 businesses in the U.S., processes tens of billions of dollars in payroll, and enables thousands of businesses to provide employee benefits such as health insurance, 401(k) retirement plans and 529 college savings plans, ...