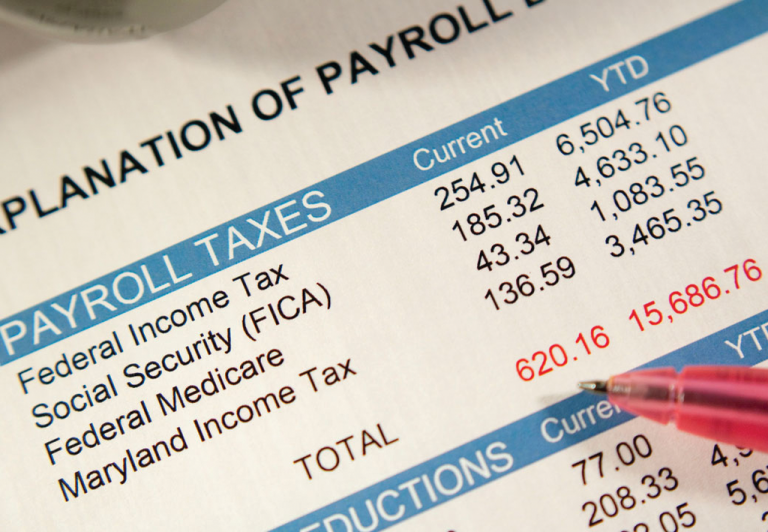

Payroll Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Will the Rise in the Federal Unemployment Tax Affect Your Clients?

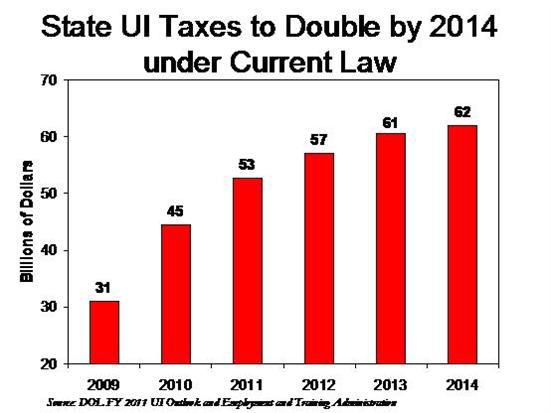

Your payroll clients are already paying FUTA, a federal tax levied on employers that are covered by their state's unemployment insurance program. Depending on where they're located, your clients may face an increase in FUTA when they file their 2013 taxes.

How to Reduce Your Clients’ SUTA Tax Rate in 2014

This month, we'll look at state unemployment tax, or SUTA. Unlike FUTA, SUTA offers employers in many states a way to reduce their tax rates in 2014. It's called a "voluntary contribution."

Payroll Systems Becoming More Mobile, with More Employee Self-Service Options

As we began 2013, taxpayers were shrouded in a cloud of uncertainty concerning taxes. That seemed to quickly be resolved for this year and into 2014, but we are now faced with a number of new tax and payroll issues.

Ohio Worker’s Comp system denies that it overbilled employers

Backed by business and labor groups, the state agency for injured workers has filed new legal documents in its fight to overturn a judge's ruling that some employers were overcharged $860 million in workers' compensation premiums from 2001 to 2009.

Payroll service provider gets 6.5 year prison sentence, $26.7M restitution to IRS

A federal judge on Friday sentenced Robert R. Sacco, the owner of a Dayton, Ohio-based payroll company, to 6 1/2 years in prison and ordered him to pay $26.7 million to the Internal Revenue Service.

New online payroll service automatically maintains state and federal payments

Wave has announced the addition of Payroll Tax Service in 10 U.S. states.

New Decision Support Network Launched to Help Payroll Departments

Bloomberg BNA has launched the International Payroll Decision Support Network. This new membership-based service combines Bloomberg BNA's custom research offerings with a collection of new global payroll products and resources accessible to subscribers online.

Massachusetts reports employment downturn in April

Higher payroll taxes and federal sequestration spending cuts are keeping the Bay State stuck in a "soft patch" of economic growth that could last until the end of the year unless federal fiscal policy changes are put into immediate action, experts said yesterday, as new numbers show the state losing jobs.