Payroll Taxes

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Don’t Let Retirement Tax Benefits Pass By Your Business Clients

Tax professionals have the opportunity to help reduce their business clients’ taxes by recognizing the opportunity for a retirement plan.

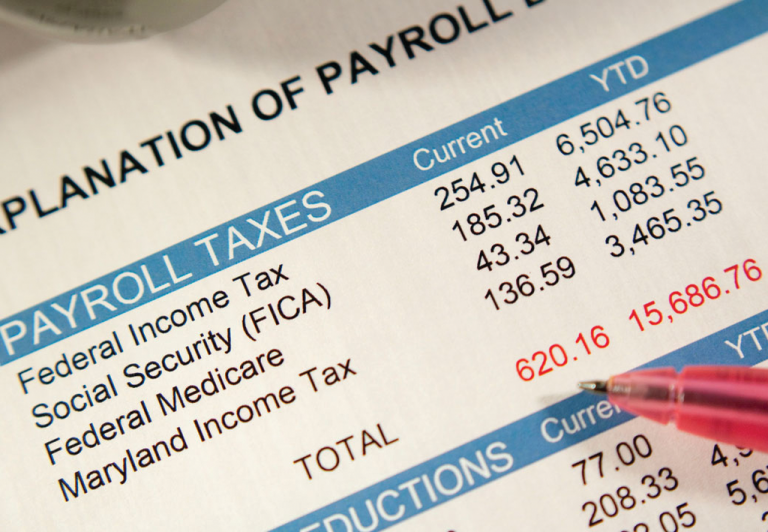

5 Changes Coming to Social Security in 2024

As inflation lingers, the Social Security Administration (SSA) is boosting its cost of living adjustment (COLA) for benefit checks in 2024. It’s just one of many changes announced by Social Security recently.

IRS Watches for Misclassified Independent Contractors, But There is a Safe Harbor Rule

An employer in danger of being assessed back taxes for certain workers may avoid liability if it qualifies for “Section 530 relief.”

Kansas Business Owner Pleads Guilty to $2.2 Million Employment Tax Scheme

A Kansas woman pleaded guilty on Sept 1, 2023, to willfully failing to account for and pay over employment taxes to the IRS.

New Jersey Business Owner Failed to Pay $10 Million in Payroll Taxes

A New Jersey business owner faces a federal prison sentence after failing to pay more than $10 million in payroll taxes.

Colorado Businessman Gets 15 Months for $737K Employment Tax Evasion

A Colorado man has been sentenced to 15 months in prison for evading the payment of more than $700,000 in employment taxes he owed to the IRS.

California Construction Company Owner Guilty of Employment Tax Crimes

He was found guilty of not timely filing employment tax returns and did not pay withholdings to the IRS for 2014 and the last three quarters of 2015.

Colorado Department of Revenue Seizes Headquarters of Boston Market Over Unpaid Sales and Payroll Taxes

McDonald’s purchased Boston Market in May 2000, eventually selling it to Sun Capital Partners, a private equity firm in 2007, which in turn sold the company to the Rohan Group during the pandemic.