Payroll Software

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

2015 Review of Intuit Online Payroll for Accounting Professionals

Online Payroll for Accounting Professionals that offers accounting professionals to obtain payroll services at wholesale prices. Pricing levels drop significantly as the number of clients increase, making this a profitable income stream for professionals.

2015 Review of Cougar Mountain – Denali Payroll

Denali Payroll is Cougar Mountain Software’s payroll system. Designed to integrate with other Cougar Mountain software modules, the product can also be used as a stand-alone payroll system.

2015 Review of Professional Payroll Systems

For accounting firms considering adding payroll to their suite of products that are offered to clients, the payroll reviews this month will certainly come in handy. And for those already offering these services, it never hurts to see what’s available.

Building a Thriving Payroll Practice

Now serving clients in 30 states, he says the feature of Payroll Relief he values the most is the ability to securely send payroll runs to his clients where they can print payroll checks at their location. The system also has direct deposit. Year-end repo

Thinking of Expanding Your Payroll Business? Consider Offering Benefits Administration Services

As you start evaluating your clients and current service offerings, consider ways you can provide additional services to clients, starting with existing clients.

2016 Minimum Wage Increases by State

Did You Know? Minimum wage increases have gone into effect in several states. Here are the states that have enacted an increase in 2015: Alaska: $8.75 per hour effective February 24, 2015; $9.75 per hour effective January 1, 2016 Arizona: $8.05 per hour effective January 1, 2015; adjusted for inflation every January 1 Colorado: $8.23 […]

Time’s Running Out to Comment on DOL Proposed Rules

The DOL's proposed changes would double the salary requirement to qualify for the executive, administrative and professional exemptions.

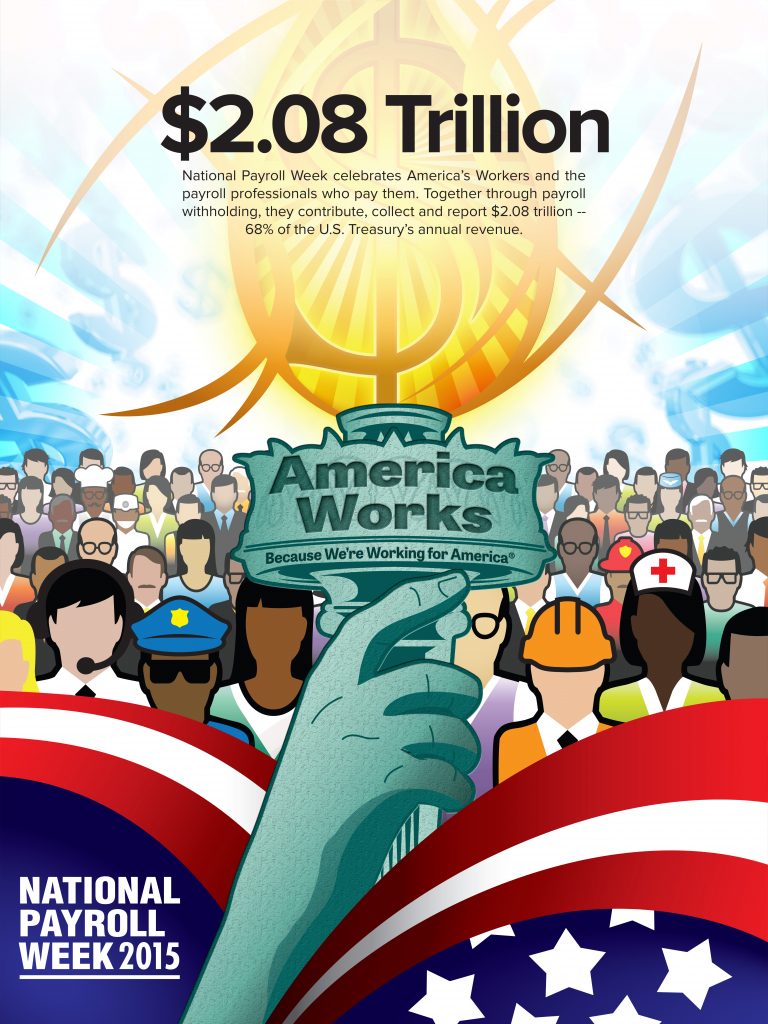

Celebrate Yourself – It’s National Payroll Week!

September brings a special treat to payroll practitioners and the payroll profession at large: National Payroll Week, which celebrates both wage earners and payroll practitioners.