Legislation

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Colorado Pot Tax Revenue Less than Expected

Colorado's lower taxes on medicinal marijuana are hindering projected tax revenue from recreational pot sales, according to a recent study released by the state's Department of Revenue.

Taxes a Problem for Legal Marijuana Sellers

A new tax snag that has hit marijuana stores could cause delays in new openings, higher product prices, and even closures of newly opened stores.

Most Americans Still Worried Obamacare Health Exchanges Will Fail

As the implementation of the new healthcare law, the Patient Protection and Affordable Care Act (better known as Obamacare) continues, a new survey shows that most Americans think that the exchanges that are designed to provide health insurance will fail.

Insurance Rebates On Way to Many Consumers and Businesses

California is just one of many states where health insurers owe refunds to thousands of consumers and businesses under requirements of the federal healthcare law. For California alone, the total refunds equal about $11.9 million.

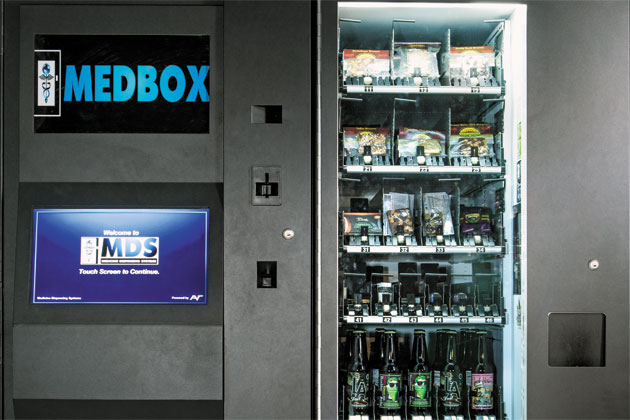

Are Marijuana Vending Machines the Next Step? Doctors are Asking for Them

Are vending machines the next step for marijuana distribution and sales?

Thomson Reuters Releases 2014-2015 Tax Planning Guide

Thomson Reuters has released the 2014-2015 edition of the Tax Planning Guide, which accountants, lawyers, tax professionals, and financial advisors distribute to clients and prospects.

Supreme Court Rules Businesses Don’t Have to Cover Contraception

In their 5-4 decision, the justices recognized for the first time that for-profit business such as East Earl, Pa.-based Conestoga Wood Specialties, owned by a Mennonite family, can hold religious views derived from their owners under federal law.

How Employers and Accounting Firms Can Navigate Obamacare Penalties

Thomson Reuters has released a special report for employers, accounting firms, and other professionals who advise business clients, Get Ready to Play or Pay: Employer Shared Responsibility Under Health Care Reform. The report highlights key provisions employers must understand to avoid tax penalties related to the Affordable Care Act.