IRS

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

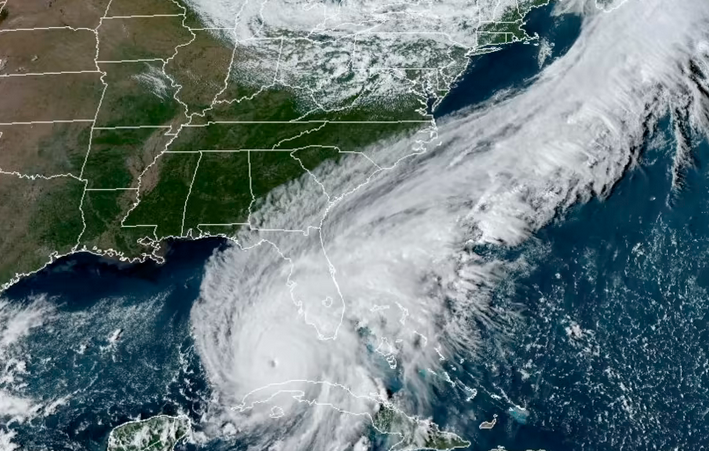

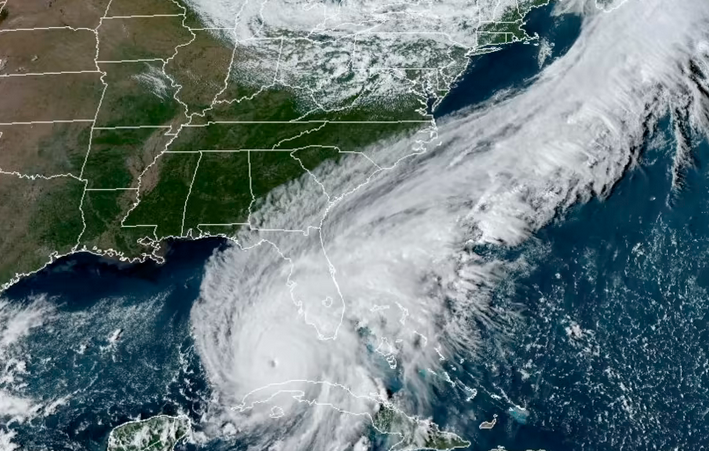

Hurricane Ian and Taxes: How CPAs and Tax Pros Can Help Their Clients

With the IRS providing tax relief for victims of Hurricane Ian, CPAs and other advisors are likely to get hit with questions. Here’s everything you need to know to help your impacted clients get the financial relief they need.

IRS Finds 79 Criminal Fugitives in Central America in First Year of New Program

Eight of those fugitives have been apprehended to face criminal proceedings or sentences.

October FBAR Extension Deadline is Fast Approaching

Filers who missed the April 15 due date received an automatic extension until Oct. 15, 2022, to file the FBAR.

IRS Employees Face Prison Time for Defrauding COVID-19 Relief Programs

The five people charged allegedly used PPP or EIDL funding to buy cars, luxury goods, and for personal travel.

IRS Warns of Huge Increase in Scam Texts

So far in 2022, the IRS has identified and reported thousands of fraudulent domains tied to multiple MMS/SMS/text scams (known as smishing) targeting taxpayers.

Hurricane Ian Victims Granted Tax Extensions

Hurricane Ian victims throughout Florida now have until February 15, 2023, to file various federal individual and business tax returns and make tax payments.

IRS Increases Per Diem Rates

For lower-cost locations of business travel, the daily per diem rate will be $204. The high rate will be $297.

The IRS Botched Lots of Child Tax Credit Payments, Audit Finds

Millions of ineligible people received payments, while millions of eligible taxpayers did not get their money.