IRS

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

TIGTA: IRS Gave Out More Than $10 Billion in Excess Child Tax Credits in 2021

The IRS miscalculated 2021 child tax credit payments for thousands of eligible taxpayers as of May 5, 2022, TIGTA said.

Ins and Outs of the Home Sale Exclusion

Here are several key points about the home sale exclusion that you should know about before you hand over the keys.

Key In on Improved Home Energy Credits

The IRS is reminding taxpayers that they may qualify for expanded home energy credits in 2023 (IR-2023-97, 5/4/23) There are two types of credits.

WISP Required! Key Components in Your Firm’s Written Information Security Plan

While primarily targeted at companies maintaining more than 5,000 client records (think tax returns), certain safeguard components are required for firms with fewer than 5,000 records.

IRS, Treasury Issue Proposed Guidance on Monetization Options for Energy Tax Credits

The proposed rules released on June 14 focus on elective pay and transferability of credits under the Inflation Reduction Act.

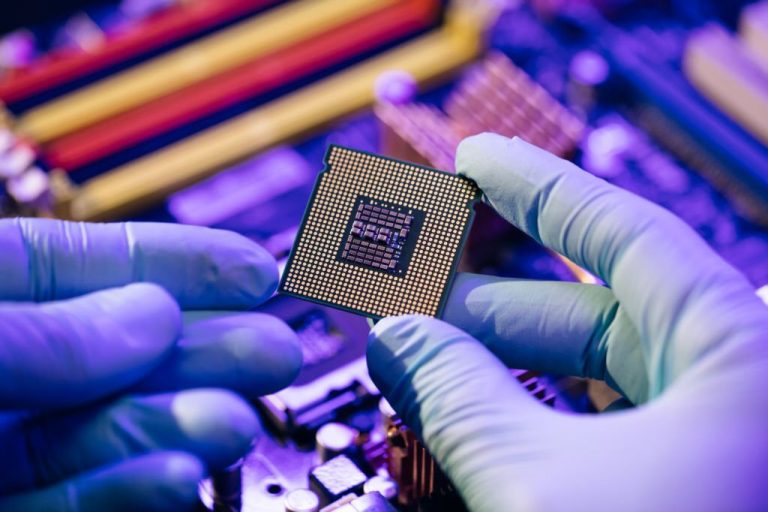

IRS Clarifies Elective Payment Rules for Semiconductor Chips Tax Credit

The CHIPS Act allows eligible taxpayers to make an election to treat the credit as a payment against federal income tax.

When to Make Nondeductible IRA Contributions

When should you begin to make nondeductible contributions to your IRA?

AICPA Supports Changing Requirements to Form 1099-K Reporting Threshold

For many months, the American Institute of CPAs (AICPA) has expressed its concerns regarding the lowered Form 1099-K reporting threshold