IRS

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

IRS Budget Cuts and Late Start to Tax Season May Delay Income Tax Refunds

Here’s a holiday season lump of coal you might not be expecting: the tax refund you count on to help pay those holiday bills very likely could be delayed, as the Internal Revenue Service (IRS) said the filing season will start on Jan. 31, instead of the initially-planned Jan. 21.

Report Shows IRS Contractors Owe Millions in Back Taxes

According to a new report, more than 1,100 vendors doing business with the Internal Revenue Service (IRS) owe a combined $589 million in Federal tax debt.

IRS Names New Members of Electronic Tax Admin Advisory Committee

The Internal Revenue Service has announced the selection of three new members and a chairperson to the Electronic Tax Administration Advisory Committee (ETAAC).

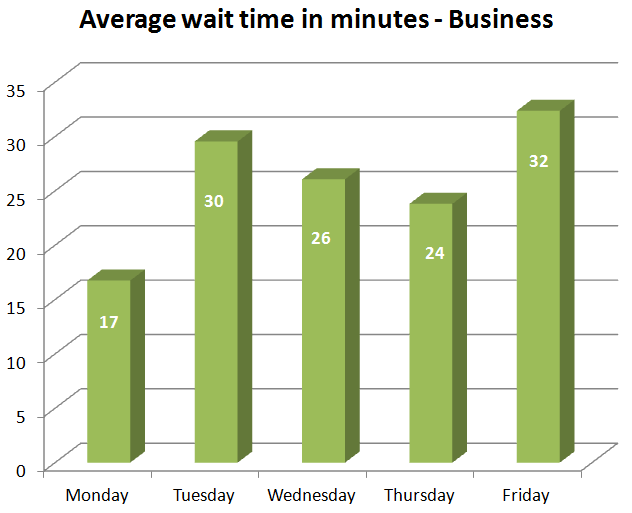

What’s the Best Time to Call the IRS?

Anyone who has ever tried to call the Internal Revenue Service knows what to expect first ... a wait. Sometimes a really long one. For tax professionals who need to reach the IRS more frequently, this can be a waste of precious time and productivity.

Report Addresses New IRS Capitalization Regulations

Thomson Reuters Checkpoint Releases Special Report for Tax Professionals on New Capitalization Regulations

Report Says IRS Should Do More to Reduce EIN Fraud

Report says the IRS needs to do more to prevent fraud committed using stolen EINs.

Four steps to bill more for practice and procedure work

Like most practitioners, I had trouble successfully billing for post-filing work. The reasons are complicated. It’s often an issue of back-and-forth time with clients or the IRS/state taxing authorities.

Taxes and Politics: IRS Proposes New Rules for Some Tax Exempt Organizations

This proposed guidance defines the term “candidate-related political activity,” and if accepted, would amend current regulations by indicating that the promotion of social welfare does not include this type of activity.