IRS

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

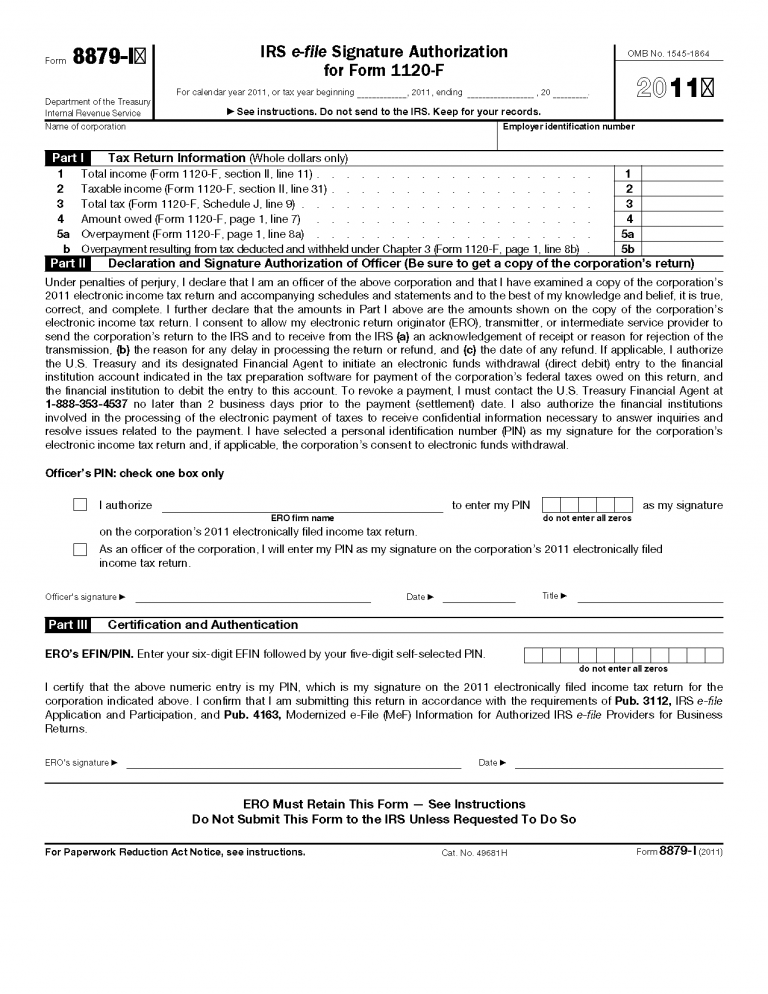

Downloadable Form 8879 IRS E-File Signature Authorization – 2014 Tax Year

Downloadable and printable version of IRS Form 8879.

Printable TY 2014 IRS Form 7004 – Automatic Extension for Business Income Taxes – For Filing in 2015

Printable TY 2014 IRS Form 7004 - Automatic Extension for Business Income Taxes - For Filing in 2015

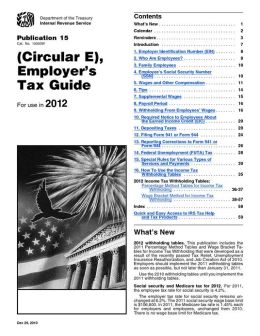

IRS Circular E, Publication 15 – Printable 2015 Employers Tax Guide (PDF)

Printable IRS Employers Tax Guide.

When to Expect a 2015 Income Tax Refund from the IRS

It's almost that time of year again... Tax season. And one of the top-searched questions each new year, at least until around April 15, is "When can I expect my income tax refund?"

Taxpayers with an IRA Account Can Still Cut 2014 Income Taxes

The year 2014 may be officially in the past, but there's still time for many Americans to gain notable tax savings.

IRS Says Income Tax Season to Start January 20

Following the passage of the extenders legislation, the Internal Revenue Service announced today it anticipates opening the 2015 filing season as scheduled in January.

IRS Issues New Procedure for Offers in Compromise Appeals

The Internal Revenue Service is releasing a revenue procedure today providing rules for the nationwide rollout of post-Appeals mediation for Offer in Compromise (OIC) and Trust Fund Recovery Penalty (TFRP) cases. The IRS Office of Appeals originally ...

IRS Hiring Practices and Salaries Examined in Report

A new report says the Internal Revenue Service (IRS) used its legislative authority appropriately when it temporarily hired employees at salaries higher than those typically given to Federal Government senior executives.