IRS

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

IRS and British Tax Agency to Co-Host International Criminal Tax Symposium

The symposium focused on combatting offshore tax evasion and international financial crimes—including cyber-crime—and brought together delegates from criminal tax and enforcement programs from the U.S., Australia, Canada, The Netherlands, New Zealand, ...

3 Ways Obamacare Affects Income Tax Returns

Unless you’ve been way out of touch, you probably know that a key part of the Affordable Care Act (ACA), aka Obamacare, requires that taxpayers have qualifying health care coverage. Those without will need to qualify for an exemption, or pay a penalty.

AICPA Urges Congress to Give IRS More Flexibility on Granting Tax Code Section 9100 Relief

The American Institute of CPAs is urging top tax lawmakers in the U.S. Congress and Senate to give the IRS the authority to grant relief in appropriate situations when taxpayers miss a statutory deadline or make an error in making an election.

Printable IRS Form 2848 – Power of Attorney and Declaration of Representative

Printable IRS Form 2848 - Power of Attorney and Delcaration of Representative

Printable Income Tax Forms and Instructions – for Tax Year 2014

It's tax season and, of course, that means searching for numerous forms, schedules and instructions needed to file taxes by April 15 (or at least an extension). This list of common IRS tax forms below are here to make it easy.

Printable 2015 IRS Form W-4

Printable 2015 IRS Form W-4

Printable IRS Form 1040EZ for 2015 – Tax Year 2014

Printable IRS Form 1040EZ for 2015 - Tax Year 2014

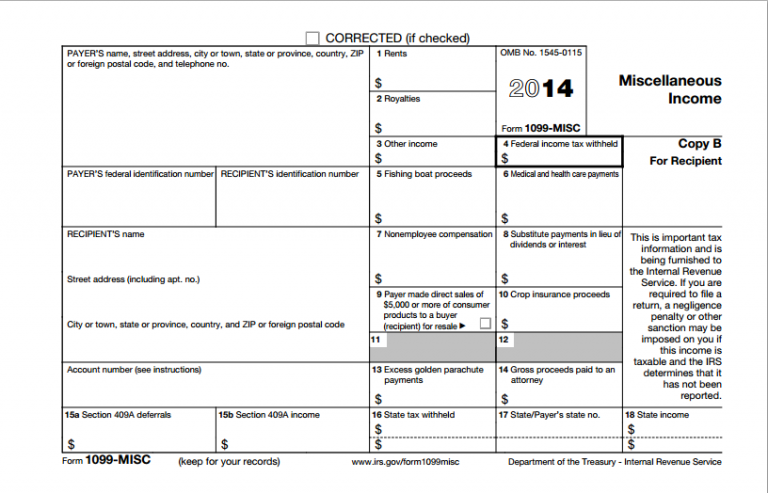

Printable 2014 Form 1099-MISC Instructions

Official instructions for Tax Year 2014 Form 1099-MISC (for filing by April 2015).