IRS

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

IRS Phone Lines Backed Up, Agency Recommends Using Online Tools

The IRS reminded taxpayers the Presidents Day holiday period typically marks one of the busiest weeks of the tax filing season for its phone lines. There are other alternatives to help taxpayers find answers to commonly asked tax questions.

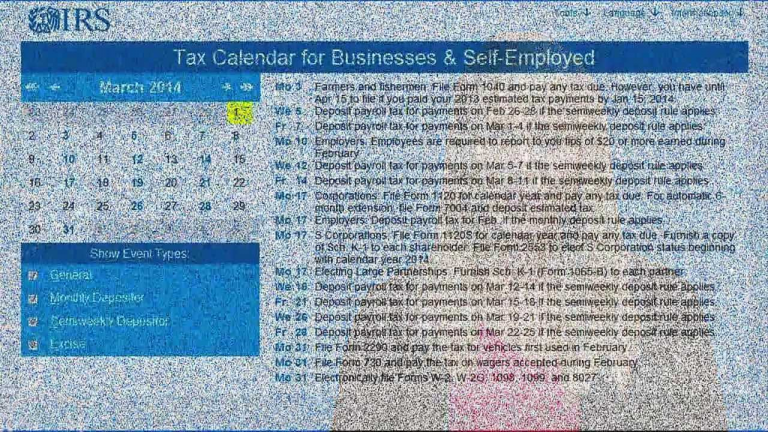

How Small Businesses & Self-Employed Can Use the IRS Online Tax Calendar

For small business owners and other self-employed individuals required to make regular tax deposits or payments, keeping track of them can be complicated. This video shows how these taxpayers can use the business due dates feature and other functions in t

IRS Says 2015 Tax Season Off to Record Start – Average Refund $3,539

The 2015 tax filing season is off to a strong start with most taxpayers filing their returns electronically and choosing direct deposit for their refunds, according to the Internal Revenue Service.

Before Hiring a Tax Preparer, Check Their Credentials

The IRS and other groups warn that people shouldn’t trust their private financial documents to just anyone. It’s good to know exactly what their tax preparer’s credentials mean, and whether they really qualify as credentials at all.

New Features Added to IRS2Go Income Tax App

The Internal Revenue Service has released IRS2Go 5.0, an update to the only official IRS smartphone application, compatible with both Apple and Android devices.

IRS Creates Online Directory of Tax Preparers

The has launched a new, online public directory of tax return preparers. This searchable directory on IRS.gov will help taxpayers find a tax professional with credentials and select qualifications to help them prepare their tax returns.

IRS Targets Tax Shelter Abuses, Misuse of Trusts

The Internal Revenue Service is targeting abusive tax shelters and structures it says some Americans use to avoid paying taxes. The agency says the problem has been a lingering issue, and so it has been added to the annual list of tax scams known as the “

How to Get a Charitable Tax Deduction Without Donating Anything

It’s very rare in the tax world when you can “get something for nothing.” But that’s essentially what happens when a real estate owner donates a qualified conservation easement to charity. In essence, the property owner is merely agreeing to keep the land