IRS

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

AICPA Urges IRS to Increase Safe Harbor Threshold

AICPA says the de minimis safe harbor threshold amount under the tangible property regulations for small business taxpayers without an applicable financial statement (AFS) be increased from $500 to $2,500.

IRS Takes Average of 278 Days to Resolve Identity Theft Cases, and That’s an Improvement Over 2013

Victims of identity theft continue to experience delays and errors in receiving refunds, according to a report publicly released today by the Treasury Inspector General for Tax Administration (TIGTA).

Report: IRS Depended More on Technology During 2015 Filing Season than Previous Years

The filing season, defined as the period from January 1 through mid-April, is critical for the IRS because it is during this time that most individuals file their income tax returns and contact the IRS if they have questions about specific laws or filing

For Taxpayers Who Missed the April 15 Deadline, Here’s What To Do

So, what can a taxpayer do if they didn't file in time, but they also don't want to keep their head buried in the sand? For most Americans who are owed a tax refund by the IRS, there's no need to panic. The tax agency doesn't assess penalties when a ...

Hey Millennials: What Are You Doing With Your Tax Refund?

Millennials are about to get millions of dollars from the IRS. What they plan on doing with it may tell us whether they will be the frugal types they are sometimes credited with, or will follow in the free-spending footsteps of the generation before them.

Here’s What the IRS Does to People Who Fudge the Truth on Charitable Donations

Court nullifies $37,000 deduction for donations of used property to charities, then adds 20% penalty.

Split Decision on IRAs: Pub 590-B Covers Distribution Rules

The new Pub. 590-B applies to 2014 tax returns filed in 2015. Two aspects that have often befuddled taxpayers in the past are the RMD rules for Roth IRAs and the options available when inheriting traditional IRAs.

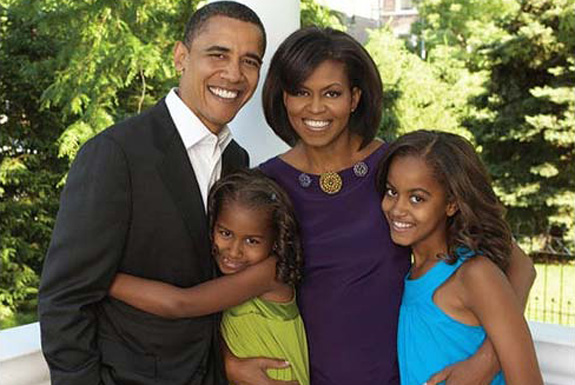

President Obama’s Income Tax Return Shows Drop in Earnings

In his sixth year in office, President Obama’s taxable income has continued to decline, according to his 2014 tax return.