IRS

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

IRS Increases HSA Contribution Limits for 2025

Beginning in January, you'll be able to contribute more to your health savings account, based on the IRS's latest inflation adjustments.

Ledgible Program Assesses a Company’s Readiness for 1099-DA Reporting

The new program follows the release of the draft Form 1099-DA for digital asset transaction reporting by the IRS last month.

IRS Chief: $400 Million in ERC Claims Have Been Withdrawn

During a House Appropriations subcommittee hearing May 7, Danny Werfel gave lawmakers an update on the tax credit's status.

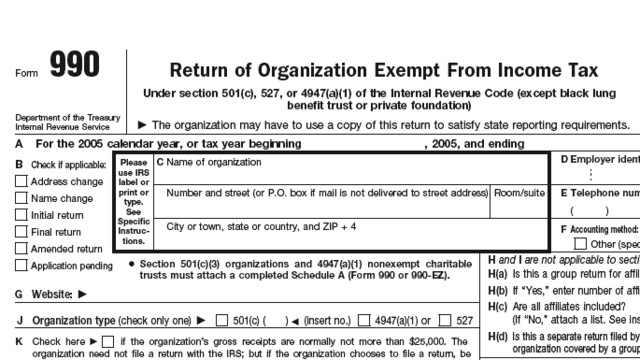

The Next Tax Deadline is May 15 for Tax-Exempt Orgs

While the April 15 tax deadline for most Americans to file their individual annual tax returns has passed, there are several deadlines each year, some for individuals, businesses, nonprofits and even organizations that are tax-exempt.

IRS Issues FAQs on Disaster Relief For Retirement Plans and IRAs

The FAQs are intended to assist individuals, employers, and retirement plan and IRA service providers, the IRS said.

More Rich Americans Will Soon Be Hit With an IRS Audit, Werfel Pledges

But the IRS chief emphasized once again that audit rates won't increase for small businesses and taxpayers making under $400,000.

EV Makers Win Two-Year Extension to Qualify for Tax Credits

The Biden administration on May 3 gave carmakers a partial reprieve in finalizing electric vehicle tax credit rules.

AICPA Provides Comments on the Tax Classification of Purpose Trusts

The recommendations would simplify filing for taxpayers and practitioners and will reduce the administrative burden on the IRS.