IRS

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Tax Tips: 16 Ways to Beat the IRS in 2016 – Year-End Tax Planning Series

The best tax advice you can get is to speak with a CPA or Enrolled Agent. These tax experts can help develop a tax strategy designed around your specific needs and situation, and they are the only professionals who can represent you before the IRS.

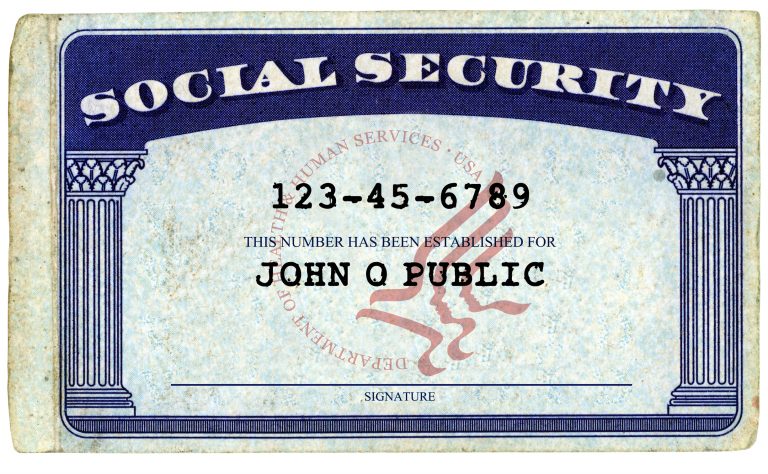

IRS Over Exposing Social Security Numbers on Documents, Says Report

An Office of Management and Budget mandate required the IRS to eliminate the unnecessary use of SSNs by March 2009. However, the IRS suspended work on the forms, letters, and systems components of its SSN Elimination and Reduction Program in ...

IRS Failing to Revoke PTINs of Felons, Other Non-Compliant Tax Return Preparers

The review identified 3,001 preparers with a felony conviction on their application; 87 reported a crime related to Federal tax matters. Processes do not ensure that PTINs assigned to prisoners or individuals barred from preparing tax returns are ...

Why Florida Leads Nation in ID Theft Income Tax Refund Fraud: IRS Cracking Down

Florida has been in the news a lot recently, and probably not for reasons that promoters of the Sunshine State would prefer. The spotlight is because hundreds of people have been arrested over the past year for identity theft crimes that involved filing bogus income tax returns for thousands of taxpayers, and then having the refund checks sent to the criminal. And more than 33,000 Florida residents have claimed identity theft in the past year.

IRS Begins Exchanging Tax Information With Other Nations: Focus On Enforcing FATCA

With a focus on enforcing FATCA, the Foreign Account Tax Compliance Act, the Internal Revenue Service is now exchanging financial account information with the taxing authorities in selected countries.

Woman who bragged on Facebook about tax fraud gets 21 year sentence

Rashia Wilson, a self-proclaimed "queen of IRS tax fraud," was sentenced today to 21 years in federal prison.

IRS failing in efforts to curb ID theft tax fraud

The IRS is running into problems as it struggles to get control over the wave of identity theft tax refund fraud that has engulfed the Tampa, Florida, area and spread to other parts of the country over the last three years.

IRS Gives Tax Relief to Farmers and Ranchers in 48 States and Puerto Rico

The one-year extension of the replacement period announced today generally applies to capital gains realized by eligible farmers and ranchers on sales of livestock held for draft, dairy or breeding purposes due to drought.