IRS

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

New Law Preserves Section 179 Tax Breaks

For many small business owners, those long and annoying depreciation schedules will soon become a distant memory. Under the Protecting Americans from Tax Hikes Act (PATH) of 2015, the maximum Section 179 deduction of $500,000 is restored retroactively...

Printable IRS Form 1040-EZ (For Taxes To Be Filed in 2016)

This IRS Form 1040-EZ is for reporting income received from Jan. 1 to Dec. 31, 2015, which the recipient will file a tax return for in 2016. The form says 2015 because it is for reporting income earned in 2015.

Printable 2016 IRS Tax Form 1040

This IRS Form 1040 is for reporting income received from Jan. 1 to Dec. 31, 2015, which the recipient will file a tax return for in 2016. The form says 2015, because it is for reporting 2015 income.

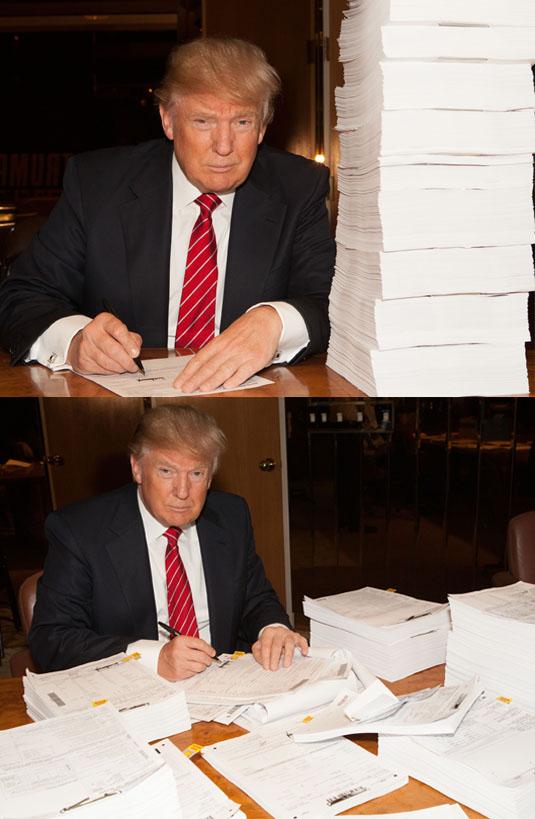

New Study Pokes Holes in Trump’s Tax Plan

Calls for federal income tax cuts are a time-honored tradition by presidential candidates of all stripes, but the Tax Policy Center study says that Trump’s plan dwarfs the proposals made by other GOP contenders.

The 5 Biggest Tax Mistakes Small Business Owners Make

Whether a business is incorporated and files returns as an entity, or is an LLC and the owner files a Schedule C with their personal 1040 income tax return, there are many potential areas for errors, from misreporting income or expenses, to missing ...

Report Says IRS Needs To Take Steps To Prevent Fraudulent Refunds

TIGTA initiated this audit because an IRS employee reported to the TIGTA Office of Investigations that the IRS was not working some taxpayer cases in which refunds were held. The Office of Investigations identified that the IRS did not timely address ...

Chart Shows When Will You Get Your 2016 Income Tax Refund

When will you get your income tax refund? If you're one of the millions of Americans who are asking that question (or will be in the coming weeks), we have the answer. It depends on a couple of factors, but the good news is that there are several ...

The Worst Tax Penalties and How to Help Your Clients Avoid Them

There is one tax saving approach we can always assist our clients with, and that is educating them about tax penalties. What follows is a list of the most punitive tax penalties along with simple tips on making sure your clients are never ...