IRS

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

2016 Fringe Benefits Tax Series #6: Dependent Care Assistance Plans

To help ease the burden of hard-working parents, employers may institute a dependent care assistance plan for employees. Under such a plan, payments made to third parties like babysitters and day care centers are excluded from income if the costs ...

IRS Crowdsourcing Contest Winners Improve Taxpayer Experience

Winners of a crowdsourcing contest sponsored by the Internal Revenue Service were recently announced. “Tax Design Challenge” encouraged innovative ideas for the taxpayer experience of the future.

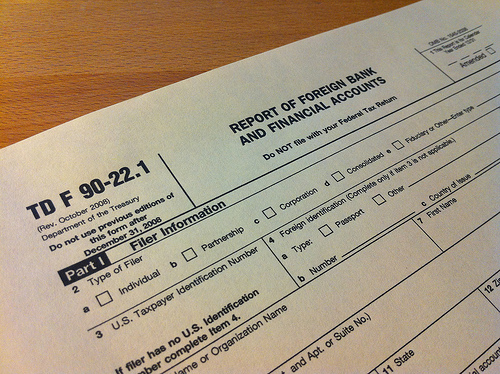

Tax Time for Foreign Accounts: FBARs Due June 30

It's tax time again. Americans with bank or investment accounts located outside of the United States, or signature authority over such accounts, have until June 30 to file an FBAR.

Congressional Committee Votes to Censure IRS Commissioner

Koskinen took over the reins at the IRS in December 2013. Despite the charges levied against him, he has previously said that he intends to stay on until the end of his four-year term.

IRS To Hold EITC and ACTC Tax Refunds Until Mid-February Starting in 2017

The IRS says that, next tax season, processing of early-filed income tax returns with the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) will be delayed. Specifically, the agency will hold tax refunds until at least Feb 15.

States Could Improve Business Tax Compliance By Sharing Data

Business tax non-compliance is a problem that plagues states across the U.S., but could be improved if states were able to more easily share data, according to new research by the Governing Institute. The survey of tax and revenue officials across 29 ...

No Change for IRS Interest Rates in 3rd Quarter 2016

Under the Internal Revenue Code, the rate of interest is determined on a quarterly basis. For taxpayers other than corporations, the overpayment and underpayment rate is the federal short-term rate plus 3 percentage points.

IRS Strengthens Authentication Process for Online Transcripts

After being disabled last spring, Get Transcript Online is now available for all users to access a copy of their tax transcripts and similar documents that summarize important tax return information.