IRS

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

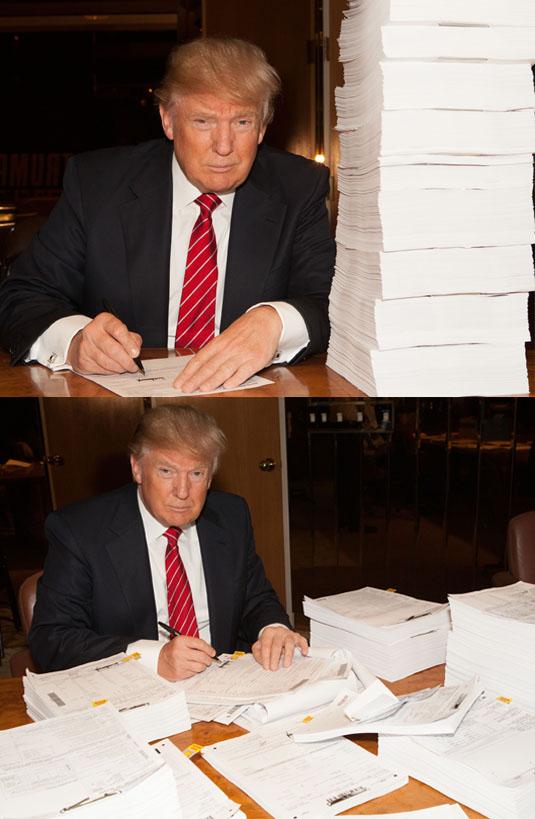

Democrats Push Harder to Get Trump’s Tax Information

With about two months left before the presidential election, Republican nominee Donald Trump still hasn’t made his tax returns available to the general public. And it doesn’t look like the billionaire is going to do it anytime soon or even before voters g

IRS Changes ITIN Program

If taxpayers have an expired ITIN and don’t renew before filing a tax return next year, they could face a refund delay and may be ineligible for certain tax credits, such as the Child Tax Credit and the American Opportunity Tax Credit, until the ITIN is r

2016 Fringe Benefits Tax Series #15: Tax-Free Commuting Expenses

For employees who live a fair distance from work, commuting can be costly and time-consuming, not to mention a hassle. At least employers may provide some relief by offering certain tax-free transportation benefits. The three main benefits are ...

IRS Warns of New Phone Scam Involving iTunes Gift Cards

The Internal Revenue Service is warning taxpayers to stay vigilant against an increase of IRS impersonation scams in the form of automated calls and new tactics from scammers demanding tax payments on iTunes and other gift cards.

2016 Fringe Benefits Tax Series #14: Retirement Planning Services

A provision for retirement planning services was added to the tax code back in 2001. As long as certain requirements are met, these benefits of such a program, which are usually reasonable in cost, are tax-free to employees and deductible by the ...

3 Tax Tips for Millennials – How to Overcome the Fear

If there’s one thing we all have in common, it’s that no one enjoys filing taxes. But, according to recent studies, millennials feel particularly anxious about the annual process.

IRS Awards $385,000 in Matching Grants to Low Income Taxpayer Clinics

The LITC program is a federal grant program administered by the Office of the Taxpayer Advocate at the IRS, led by National Taxpayer Advocate Nina E. Olson. Although LITCs receive partial funding from the IRS, LITCs, their employees and their ...

National Taxpayer Advocate Weighs In on IRS Affairs

Just like clockwork, twice a year the National Taxpayer Advocate (NTA) Nina E. Olson delivers reports to Congress on the state of affairs at the IRS. In the mid-year report released on July 7, Olson focused on a new initiative, the Public Forums on ...