IRS

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

IRS Says More Taxpayers May Qualify for EITC Due to Hurricanes

A special computation method, available only to people who lived in one of the hurricane disaster areas during 2017, may enable them to claim the EITC or claim a larger than usual credit. Under this method, taxpayers whose incomes dropped in 2017 can ...

How to Choose an Income Tax Preparer: Which Tax Pros Can Represent Taxpayers Before the IRS?

Participants in the program who are not attorneys, CPAs or EAs do not have unlimited rights. Their rights are limited to representing clients whose returns they prepare and sign, but only before revenue agents, customer service agents and the taxpayer ...

Top 10 Surprising Tax Deductions

As the year comes to a close, we have compiled some unexpected tax deductions you may be able to claim on your return as you look at getting your financial house in order and as you consider other New Year’s resolutions. Whether with your business, ...

2018 IRS Income Tax Refund Schedule

The IRS will begin processing tax returns on January 29, 2018, for income earned in 2017. In general, the IRS says that returns with refunds are processed and payments issued within 21 days. For paper filers, this can take much longer, however.

Supreme Court May Change Online Sales Tax Law

If SCOTUS decides in favor of South Dakota, that decision would pave the way for all states to tax remote sales. Exactly how they would do that is, at this point, unclear.

Cryptocurrency, Taxation, and Initial Coin Offerings

The IRS classifies cryptocurrency as property, then they turn around and issue John Doe Summonses[2] to Coinbase, which was the same thing the IRS did to foreign bank accounts, seemingly treating coin as currency. However the taxation of coin works ...

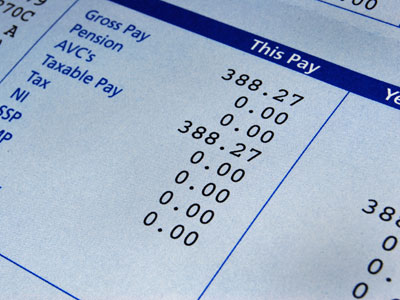

IRS Payroll Tax Withholding Chart – 2018

The updated withholding information shows the new rates for employers to use during 2018. Employers should begin using the 2018 withholding tables as soon as possible, but not later than Feb. 15, 2018.

IRS Issues New Payroll Tax Withholding Tables for 2018 Tax Reform

The updated withholding information shows the new rates for employers to use during 2018. Employers should begin using the 2018 withholding tables as soon as possible, but not later than Feb. 15, 2018.