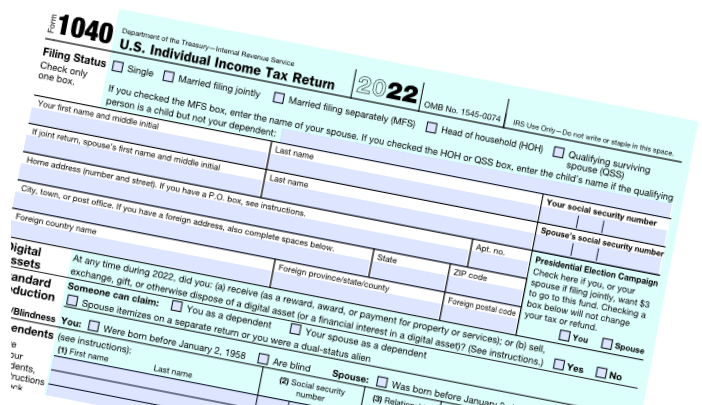

Income Tax

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

New Law Encourages Roth 401(k) Accounts

For 2023, a participating employee can contribute up to $22,500 in elective deferrals or up to $30,000 if they are age 50 or over.

IRS Says State Issued Stimulus Payments are Not Taxable

The IRS has determined that in the interest of sound tax administration and other factors, taxpayers in many states will not need to report these payments on their 2022 tax returns.

Taxpayer Advocate Rips IRS for Delay in California Tax Issue Ruling

The IRS is trying to decide whether aid payments to taxpayers in more than a dozen states should be taxable.

Don’t File Your Returns Yet, IRS Tells Millions of Taxpayers

The issue comes with stimulus payments paid by some states in the last year, which has led to tax questions.

AICPA Sends Tax Proposals to Lawmakers

The 61 recommendations in the compendium include proposals related to employee benefits, individual income tax, international tax and tax administration, among others.

Oklahoma Man Pleads Guilty to Employment Tax Scheme

Pleaded guilty to filing a Form 941 for the first quarter of 2016, but not paying over approximately $31,010 in taxes withheld from employees’ paychecks.

IRS Working on 1099 Guidance for Middle Class Tax Refund in California

The agency previously said it was working on guidance for 19 states that provided refunds of some form in 2022.

Recreational Marijuana Sales Start in Missouri

On Friday, [Feb. 5, 2023] the Missouri Department of Health and Senior Services issued licenses to 207 dispensaries across the state to legally sell cannabis to anyone over the age of 21.