Income Tax

Charitable Giving up 3.4 Percent During Summer

The latest charitable giving trends report from Blackbaud shows that overall charitable giving to nonprofits increased 3.1% and online giving increased 8.0% for the three months ending July 2014 as compared to the same period in 2013.

Using Your Car for Business Purposes? Keep Good Records for the Tax Deduction

What often sets business taxpayers apart from individuals is the potential for deducting expenses relating to business driving. For virtually everyone else, the cost associated with operating a car or other vehicle is a nondeductible personal expense. However, if you use your own vehicle for business trips, you’re usually entitled to deductions on your federal tax return.

6 Tips for Small Business Owners To Reduce Effect of Minimum Wage Increases

Recent legislation in thirteen states to raise the minimum wage, various increases in some cities across the country, and news that an executive order may soon mandate an increase on federal contracts, means small business owners will face yet another challenge to build, sustain and grow their business in a difficult economic environment.

5 Ways to Spot Fake IRS Phone Calls

The Internal Revenue Service continues to warn taxpayers across the country of a series of scam phone calls from people pretending to be IRS officials in order to get sensitive personal information. On Thursday, the agency issued a new consumer alert to provide taxpayers with additional tips to protect themselves.

Two Miami Women Face Tax Fraud Charges: $3 Million-plus in Bogus Refunds

Two Miami-Dade women have been charged with preparing dozens of phony income-tax returns and pocketing a chunk of the multimillion-dollar refunds, the U.S. attorney's office said Tuesday.

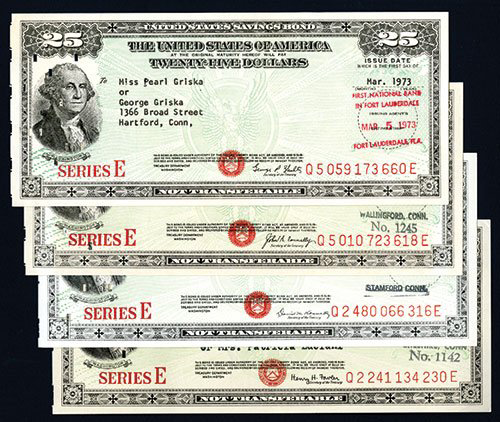

Clever Financial Strategy For Reporting Interest Earned On U.S. Savings Bonds

Currently over 50 million individuals own nearly $178 billion worth of U.S. Savings Bonds. Many don’t realize that savings bonds are subject to federal income taxes when they are either cashed in or reach final maturity, whichever comes first. The difference between the purchase price and the cash-in value is considered reportable interest. When savings bonds are cashed in, a 1099-INT is normally issued for any interest earned amount over $10. Savings Bonds are free from state and local taxes.

New Idaho Tax Break Gets First Business Applicant

An airline is looking into coming to Idaho to set up a maintenance facility in Boise that would create 100 new jobs with salaries of close to $50,000 a year, Idaho's state commerce chief says, in part because of a new tax incentive law.

Traveling Abroad for Business? Keep These Deduction Tips in Mind

As with domestic travel (i.e., travel within the 50 U.S. states and the District of Columbia), you can deduct all of your travel expenses if the trip is entirely for business purposes. Otherwise, you’re entitled to travel deductions only if the primary purpose of the trip is business-related. Again, the days spent on business versus pleasure are critical, although the IRS is lenient in treating certain days as “business days.”