Income Tax

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

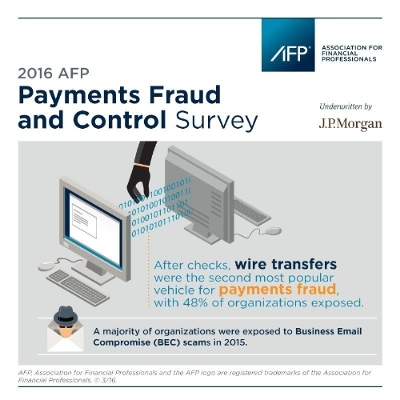

73% of U.S. Companies Report Payment Fraud Attempts in 2015

BEC scams, short for business email compromise, are an increasingly common type of fraud which greatly impacts wire fraud. In 2015, 64 percent of organizations were exposed to BEC scams. Though checks continue to be the payment method most targeted by ...

Midsized Businesses Struggling With Tax Compliance

The research revealed that nearly half of business owners do not know how many fines they incurred in the past 12 months or how much they cost their organizations.

It’s Easy To File An Income Tax Extension: All You Have To Do Is Ask

The red-letter due date for filing for individual tax returns – April 18 for most taxpayers around the country – is rapidly approaching. When it’s needed or preferred, you can obtain a six-month extension for filing Form 1040, merely by asking the IRS.

Congress Approves Taxpayer Bill of Rights

With considerably less fanfare than the Bill of Rights ratified as the first amendments to the U.S. Constitution, the 114th Congress quietly approved the “Taxpayer Bill of Rights” as part of the Protecting Americans from Tax Hikes (PATH) Act of 2015.

Exotic Dancer Found Guilty of “Tax Seduction”

This wasn’t just a case of dollar bills being tucked into a G-string. A jury determined that the dancer failed to report close to $1 million -- $850,000, to be exact -- in taxable income from performing private dances and sexual favors during the ...

More Americans Saving Income Tax Refunds

Consumers know just what they want to do with their refunds this year: In addition to savings, 34.9 percent plan to pay down debt and 22.4 percent will use the refunds for everyday expenses. While 11.4 percent plan to book a vacation, 9.2 percent plan to

There’s Still Time To Reduce Your 2015 Income Taxes

The deadline for contributions to IRAs is April 18, this year’s filing deadline. For tax year 2015, most people under 50-years old may contribute the larger of either their taxable compensation for the year, or $5,500 to a Traditional IRA; those 50 or ...

3 Smart Ways To Use Income Tax Refunds

The average tax refund in 2015 was approximately $2,800 according to the IRS, and similar refunds are expected in 2016. For those getting a refund, there are many options to consider for what to do with this unexpected income.