Income Tax

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

2018 IRS Income Tax Refund Schedule

The IRS will begin processing tax returns on January 29, 2018, for income earned in 2017. In general, the IRS says that returns with refunds are processed and payments issued within 21 days. For paper filers, this can take much longer, however.

IRS Warns of Tax Scam with Fake W-2 Forms

Here’s how the scam works: Cybercriminals do their homework, identifying chief operating officers, school executives or others in positions of authority. Using a technique known as business email compromise (BEC) or business email spoofing (BES), ...

Supreme Court May Change Online Sales Tax Law

If SCOTUS decides in favor of South Dakota, that decision would pave the way for all states to tax remote sales. Exactly how they would do that is, at this point, unclear.

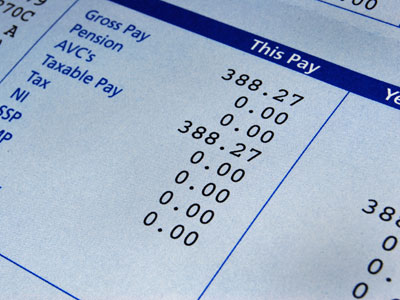

IRS Payroll Tax Withholding Chart – 2018

The updated withholding information shows the new rates for employers to use during 2018. Employers should begin using the 2018 withholding tables as soon as possible, but not later than Feb. 15, 2018.

IRS Issues New Payroll Tax Withholding Tables for 2018 Tax Reform

The updated withholding information shows the new rates for employers to use during 2018. Employers should begin using the 2018 withholding tables as soon as possible, but not later than Feb. 15, 2018.

A Final Article on Cannabis and Section 280E

For this, my final article on cannabis taxation, get ready to get your mind blown.

Tax Professionals Need to Talk about the Cannabis Industry

Today the cannabis industry is a $6 billion industry. In ten years it is projected that cannabis will be a $1 trillion industry. In my home state of Florida, cannabis became legal last year, however the state, as it legislated the laws surrounding ...

Is Your 2018 Income Tax Refund Late? This May Be the Reason, And When You Should Receive Your IRS Refund

The IRS has announced that taxpayers with the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC) will likely see delays in receiving their income tax refunds in 2018. This is due to extra fraud prevention measures the agency is implementing, which means that taxpayers with those credits will likely not see […]