Financial Planning

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

New York Firm Named Best Accountancy by Hedgeweek for 4th Year

For the fourth straight year, the New York-based accountancy Anchin, Block & Anchin has again been named the Best North American Accounting Firm in the annual Hedgeweek awards.

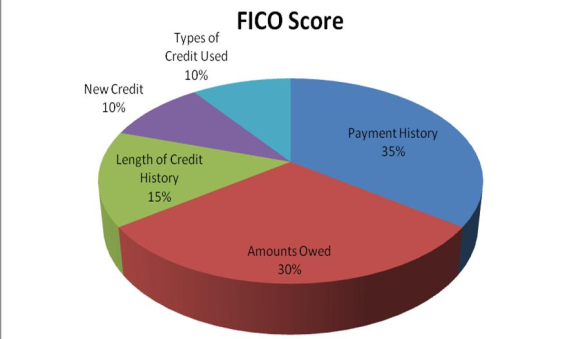

FICO to Release New Credit Scoring System

Credit and business analysis company FICO has announced a change to the well-known FICO Score, the most commonly-used measure of U.S. consumer credit risk. The new scoring system will be available beginning this summer.

Small Businesses Missing Out on Time-Saving Tech

The results show that more than half of small businesses surveyed still use manual processes, such as a spreadsheet or pen and paper, to track finances. In addition, almost 40 percent of these businesses are spending multiple days on tax preparation.

How to Increase Retirement Savings

It’s never too late to begin. The sooner you start contributing to your employer-sponsored retirement plan or IRA, the better your chances for building a significant savings cushion.

Income Taxes for Retirees: Easier, But Still Complex for Some

Think taxes get a lot easier when you retire? Like everything else in life, it depends, especially since the tax aspects of Social Security, 401(k) withdrawals and IRAs can get pretty confusing.

America Saves Week Reminds Everyone to be Prepared

Are you saving enough for retirement and overall financial security? Now many be a good time to examine just how prepared you are.

Think Twice About Once-a-Year IRA Rollover Rule

Under the federal income tax law – specifically, Section 408(d)(3)(B) of the Internal Revenue Code – a taxpayer can roll over funds from one IRA to another only once a year.

Reality Bites: The New 3.8% Net Investment Income Surtax

The specter of the dreaded new surtax on “net investment income” (NII) has turned into reality. For the first time ever, some upper-income taxpayers will have to pay the 3.8% surtax on their 2013 income tax returns. This could be a harrowing experience for some of your clients.