Financial Planning

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Intuit Introduces Quicken 2015 for Mac

Personal and business finance software maker Intuit has released the latest version of Quicken 2015 for Mac, which offers a new, clean and simple interface designed specifically for Mac users, as well as new investment management capabilities. The program also syncs with a free mobile companion app providing the ability to photograph and track receipts so users can more easily stay on top of their money.

31% of Workers Have No Retirement Savings

Nearly one third of American workers have no retirement savings or a pension, and 19 percent of workers nearing retirement age have no nest egg either, according to a new report by the Federal Reserve Board.

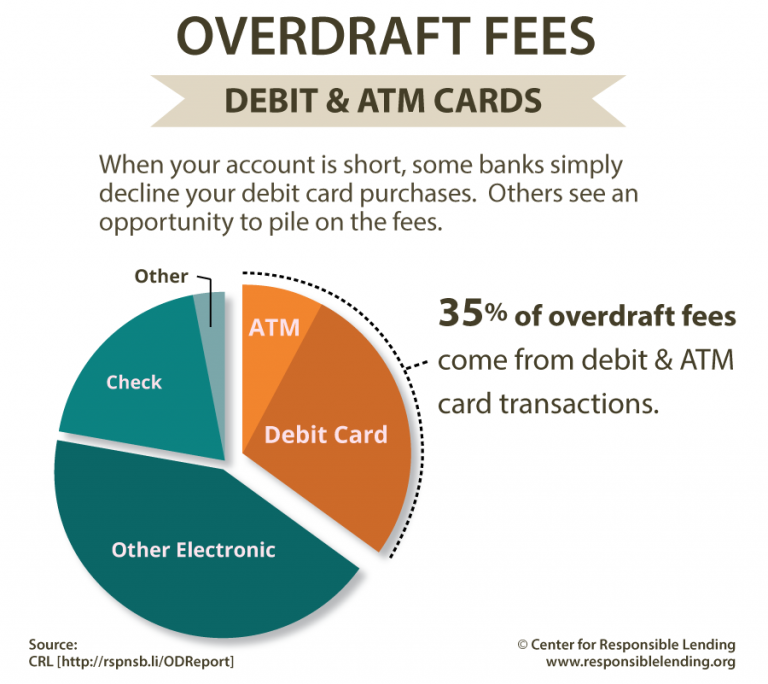

Debit Card Overdrafts Come with Hefty Fees – Over 1,000% APR for Some

A new report by the Consumer Financial Protection Bureau has found the majority of debit card overdraft fees are incurred on transactions of $24 or less and that the majority of overdrafts are repaid within three days. Put in lending terms, if a consumer borrowed $24 for three days and paid the median overdraft fee of $34, such a loan would carry a 17,000 percent annual percentage rate (APR).

Millennials are Super Savers, New Study Shows

Whatever you may think of Millennials, they are natural born savers. A new report from the Transamerica Center for Retirement Studies shows that since many of these workers entered the workforce at about the same time as the Great Recession, they've been more proactive in saving for perilous employment times.

PwC Report Examines Cyber Risks for Companies

A new report from PwC US and the Investor Responsibility Research Center Institute (IRRCi) indicates that while companies must disclose significant cyber risks, those disclosures rarely provide differentiated or actionable information. The report examines key cybersecurity threats to corporations and provides information to investors struggling to evaluate investment risk, business mitigation strategies and the quality of corporate board oversight.

Most Microbusiness Entreprenuers Using Personal Savings to Stay Afloat

As new and alternative funding sources target small businesses and increasingly penetrate the U.S. market, less than three percent of U.S. microbusiness owners report using government loans (2.7%), small business loans (2.4%) or crowd-funding (1.9%) to fund their business, according to the Sam’s Club/Gallup Microbusiness Tracker.

Americans Stockpiling More Money in Checking Accounts

Americans squirreled away more money in their checking accounts in 2013 than they did at any time in the past 25 years, suggesting that they remain spooked by the Great Recession, a new report shows.

Study Finds that Financial and Physical Health are Related

What do personal finances and personal physical health have in common? More than you might think.