Benefits

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

BlackLine Acquires Rimilia

Rimilia is a provider of accounts receivable automation solutions that enable organizations to control cash flow and cash collection in real time. Using artificial intelligence (AI) and machine learning, the SaaS (Software-as-a-Service) platform ...

New Details Offered on IRS Syndicated Conservation Easement Settlements

The Internal Revenue Service Chief Counsel has released Chief Counsel Notice 2021-001 (CC Notice), which contains information regarding Chief Counsel’s settlement initiative for certain pending Tax Court cases involving abusive syndicated ...

![Joe-Biden-Speaks[1]](https://stage-cpapracticeadvisorsite-firmworks.content.pugpig.com/wp-content/uploads/sites/2/2020/09/Joe_Biden_Speaks_1_.5f7502b8383b6-768x512.png)

Biden 2019 Tax Returns Show High Income and High Tax Rate

On the joint 2019 return filed by Biden and his wife, Dr. Jill Biden, the couple paid almost $300,000 in federal taxes on approximately $985,000 of adjusted gross income (AGI), resulting in a relatively high effective tax rate of 29.5%.

CCH AnswerConnect Users Get Access to Paychex PPP Loan Forgiveness Calculator

Paychex’s PPP Loan Forgiveness Estimator assists business owners with understanding how much of their PPP loan may be forgiven by the federal government. When accessing the tool, CCH AnswerConnect users will be asked to input a variety of ...

Transforming Accounting Services Personnel to a Client Advisory Mindset

From all indications, the transformation of the accounting profession to a more advisory focus is already well under way. Taking a learning organization approach will help ensure that your firm develops a comprehensive client advisory mindset.

Greater Diversity in Leadership Creates More Positive Employee Experience

Companies with more women in executive and management roles deliver more positive employee experiences in terms of overall career growth, pay fairness, skill building, confidence in leaders and managerial support.

Should U.S. Broaden Mandate on Auditor Rotation?

Drawing on publicly available data, the AJPT study employs a novel method to focus on the years immediately preceding and following mandated partner rotations. Joining Prof. Whited as co-authors in the AJPT’s current issue are Huan Kuang and Matthew G.

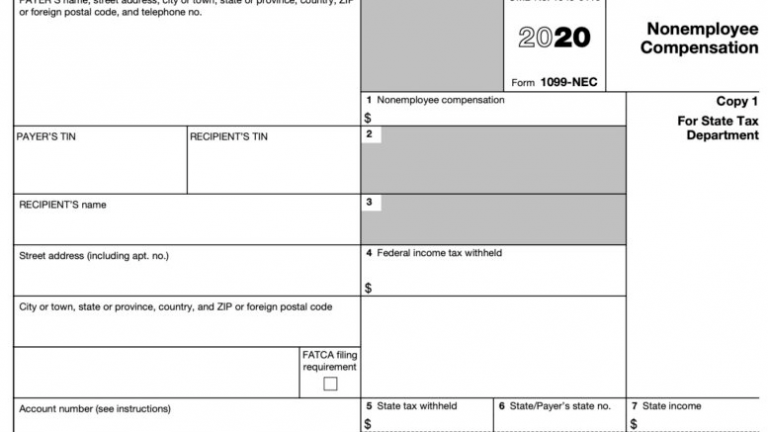

IRS Takes Non-Employee Compensation Out of 1099-MISC: New Form 1099-NEC

The 1099-NEC is used strictly for reporting independent contractor payments of $600 or more in the course of your trade or business. You will still be required to use the 1099-MISC for such items as royalties, rent, and healthcare payments.