Benefits

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

![intuit-dome-clippers[1]](https://stage-cpapracticeadvisorsite-firmworks.content.pugpig.com/wp-content/uploads/sites/2/2021/09/intuit_dome_clippers_1_.6146ef7410d2a-768x432.png)

The Intuit Dome to Open in L.A. for the NBA’s Clippers

They could have called it the TurboTax Center, or the QuickBooks Cathedral or the CreditKarma CosmoDrome, but they called it the Intuit Dome.

60% of Finance Leaders Confident in Future Proofing Plans

Despite this positive outlook, finance leaders are still anxious about what the future will hold. Over 60 percent haven't felt peace of mind about work in six months or more, and more than 80 percent have some level of anxiety about the second ...

Iris Software Acquires Conarc

The move marks the next stage in IRIS’ mission to rapidly expand its foothold in North America, following the recent acquisition of Doc.It in July 2021. IRIS continues to expand its practice management and productivity solutions as CPA firms across ...

2021 Estate Planning Tips for Business Owners

Estate planning is often in the back of many people’s minds yet tends to be avoided due to the unsettling thoughts and fears regarding death. Nevertheless, estate planning is a necessity for anyone with children, a business, personal assets, or ...

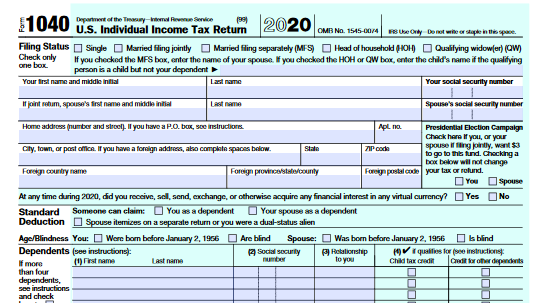

Oct. 15 is Tax Deadline for Extended 2020 Tax Returns

Taxpayers can file now and schedule their federal tax payments up to the Oct. 15 due date. They can pay online, by phone or with their mobile device and the IRS2Go app. When paying federal taxes electronically taxpayers should ...

2021-2022 Home Office Tax Deductions

To qualify for home office deductions, you must use at least part or your home regularly and exclusively as (1) your principal place of business or (2) a place to meet or deal with customers, clients or patients in the normal course of your business.

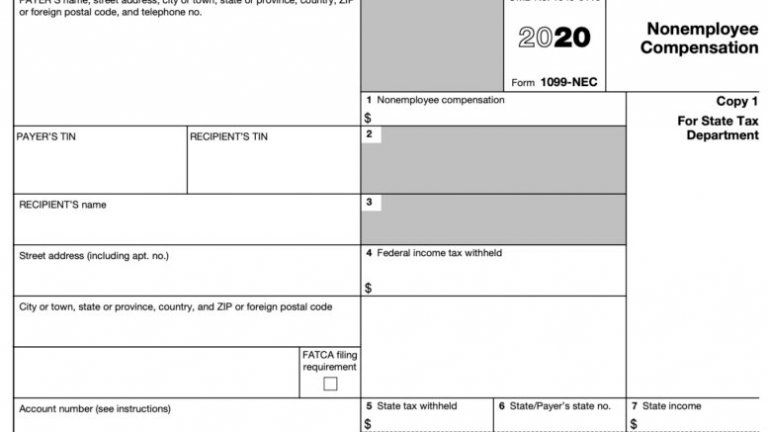

How to Classify Workers as Employees or Contractors

An employee is generally considered to be anyone who performs services, if the business can control what will be done and how it will be done. What matters is that the business has the right to control the details of how the worker’s services are ...

How to Spread Out the Tax Bite on Roth Conversions

Unless you’ve been marooned on a desert island somewhere for the last few decades, you should know all about the benefits of Roth IRAs. But you may have built a sizeable nest egg in a traditional IRA, including a rollover from a 401(k) or other ...